December 2, 2022

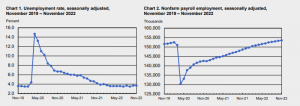

According to today’s U.S. Bureau of Labor Statistics report, nonfarm payroll employment expanded overall by 263,000 in November while the unemployment rate remained constant at 3.7 percent. There were notable job gains in the leisure and hospitality, healthcare, and government sectors. Employment decreased in transportation and warehousing as well as retail trade.

Household Survey Data

Since March, the unemployment rate has been fluctuating within a narrow range of 3.5 percent to 3.7 percent, remaining constant at 3.7 percent in November. At 6.0 million in November, the unemployment rate remained essentially unchanged. The unemployment rates for the major worker groups, including adult men (3.4%), adult women (3.3%), teens (11.3%), Whites (3.2%), Blacks (5.7%), Asians (2.7%), and Hispanics (3.9%), showed little to no change throughout the month.

In November, there were 1.4 million permanent job loses, an increase of 127,000. At 803,000, the number of those on temporary layoffs barely changed.

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.2 million in November. The long-term unemployed accounted for 20.6 percent of all unemployed persons.

The Labor force participation rate (62.1%) and the employment-population ratio (59.9%) remained at the same levels in November and have shown little net change since the beginning of the year. Both measures however are 1.3% lower than February 2020 levels prior to the COVID-19 pandemic.

At 3.7 million in November, the number of people working part-time for economic reasons was essentially steady. Due to their reduced hours or inability to acquire full-time employment, these people, who preferred full-time employment, were working part-time jobs.

At 5.6 million in November, the number of people who are currently out of the labor force but seek a job was barely changed from its February 2020 level of 5.0 million. These people were not counted as unemployed because they were not actively looking for employment in the four weeks before the poll or because they couldn’t accept a job.

In November, there were 1.5 million people who were marginally tied to the labor force among those looking for work. These people desired a job, were available to work, and had sought for one at some point in the previous 12 months, but they hadn’t done so in the four weeks before the poll. In November, the number of discouraged workers, a subset of the marginally attached—was 405,000, which was essentially unchanged from the previous month.

Establishment Survey Data

November had a 263,000 increase in total nonfarm payroll employment, nearly in line with the average growth over the previous three months (+282,000). Compared to 562,000 per month in 2021, monthly job growth has averaged 392,000 in 2022. Government, health care, and leisure and hospitality all had significant job growth in November. Employment decreased in transportation and warehousing as well as retail trade.

The leisure and hospitality industries gained 88,000 new jobs, including 62,000 in the food and beverage industry. So far this year, the leisure and hospitality industry has added 82,000 jobs per month on average, which is less than half of the 196,000 jobs added on average per month in 2021. The number of people employed in leisure and hospitality is 980,000, or 5.8%, lower than it was in February 2020 before the pandemic.

Hospitals (+23,000), nursing and residential care facilities (+10,000), ambulatory health care services (+11,000), and hospitals (+11,000) all had increases in employment in the health care sector in November. The average monthly rise in health care employment in 2022 is 47,000, significantly more than the 9,000 average monthly gain in 2021.

The government added 42,000 jobs in November, primarily in local government (+32,000). Compared to 2021, the average monthly increase in government employment has been 25,000 so far this year. Government employment has decreased by 461,000, or 2.0 percent, since February 2020.

The “other services” sector generated 24,000 new positions in November, including 11,000 in personal and laundry services. Since the beginning of the year, employment in other services has grown by an average of 15,000 per month, compared to 24,000 per month in 2021. Employment in other services is down 186,000 (3.1%) from its February 2020 peak.

Social assistance employment rose by 23,000 in November, reaching its level of February 2020. Individual and family services employment in the social assistance sector climbed by 17,000 in November. Social assistance job growth has increased by 18,000 per month on average so far in 2022, up from an average of 13,000 per month in 2021.

November saw a +20,000 increase in construction employment, with 8,000 new positions in nonresidential constructions. This year, the construction industry has added 19,000 jobs on average each month, which is similar to the 16,000 positions added each month in 2021.

The trend of rising employment in financial industries persisted (+14,000). A decrease in credit intermediation and related activities slightly offset job growth in real estate, rental, and leasing (+13,000) and securities, commodities contracts, and investments (+6,000). (-9,000). The number of people employed in financial operations has risen by 12,000 more people each month on average so far in 2018 than in 2021.

In November, there were 30,000 fewer people working in retail. General merchandise stores (-32,000), electronics and appliance stores (-4,000), and furniture and home furnishings stores (-3,000) all experienced job losses; however, motor vehicle and parts dealers (+10,000) saw an increase in employment. Employment in the retail sector has decreased by 62,000 since August.

Transportation and warehousing employment fell by 15,000 in November and by 38,000 overall since July. In November, job gains in air transportation (+4,000) partially offset job losses in warehousing and storage (-13,000) and couriers and messengers (-12,000).

Professional and business services employment barely changed in November (+6,000). Professional and technical services generated 28,000 more employment for the sector than business support services, which saw an 11,000 job loss. Professional and business services have seen an average monthly job growth of 58,000 so far in 2022, down from 94,000 per month in 2021.

Employment in the mining and wholesale trade industries, barely changed throughout the month.

All employees on private nonfarm payrolls saw an increase in average hourly pay of 18 cents, or 0.6 percent, to $32.82. The average hourly wage has climbed by 5.1 percent over the last year. Private-sector production and nonsupervisory employees’ average hourly wages increased by 19 cents, or 0.7 percent, to $28.10 in November.

The average workweek for all employees on private nonfarm payrolls fell to 34.4 hours in November, a 0.1-hour decrease. The average workweek for all employees in the manufacturing sector fell by 0.2 hours to 40.2 hours, while overtime fell by 0.1 hours to 3.1 hours. For production and nonsupervisory workers on private nonfarm payrolls, the typical workweek fell by 0.1 hour to 33.9 hours.

The change in total nonfarm payroll employment for September was changed from +315,000 to +269,000 down by 46,000, and the change in October was updated from +261,000 to +284,000 up by 23,000 between the two revisions. These changes resulted in job growth in September and October that was 23,000 less than initially estimated.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.