May 18, 2020

Victoria Mutual Investments (VMIL) for the three months ended March 31, 2020 reported total interest income of $241.75 million, an increase of 20% relative to the $201 million recorded for the corresponding period in 2019.

Interest expense for the period amounted to $161.90 million, a 29% increase relative to the $125.82 million recorded in 2019. As such, Net interest income closed the period at $79.85 million, a 6% improvement on the $75.18 million recorded for the corresponding period in 2019.

VMIL recorded loss from investment activities for the period of $6.90 million, reduction relative to the gain of $80.01 million recorded in 2019.

Net fees and commissions closed the period at $190.04 million, a decrease of 33% compared with the $281.74 million recorded for the comparable period in 2019.

Other income for the three months reflected a total of $5.39 million, an increase of 382% compared to $1.12 million recorded for last year same time. Consequently, total other operating revenue decreased 48% to close at $188.53 million (2019: $362.86 million) for the period under revenue.

Net interest income and other operating revenue amounted to $268.37 million for the three months ended March 31, 2020, 39% lower than $438.04 million booked for the first three months of 2019. The Company highlighted following:

-

- “Our Capital Markets fee income was negatively impacted as transactions in execution paused due to the instability and weak forecasts for a Global recovery from COVID-19. Nonetheless, our guidance to corporates reinforces the need for capital to bolster balance sheets, weather the revenue downturn and provide liquidity to capitalise on opportunities, which will materialise. We are assiduously working on executing transactions in our pipeline while building new deal flows for the remainder of the year.

- Bond Trading performed exceptionally well as the strategies devised generated strong gains during the review period. While bond prices have stabilised in recent weeks, the recent downgrades coupled with projected weak economic data may impact upward price movement and consequently, revenue growth in the next quarter.

- Gains from Investment Activities were negatively impacted by the downturn in the investment markets during the month of March, attributable to the projected economic fallout due to the COVID-19 pandemic. We anticipate a better performance in future reports based on the actions taken.

- Our Asset Management business generated robust growth year over year, due to our strong investment performance in 2019, combined with the expansion and improved productivity of our sales team.

- Net Interest Income, despite the challenges of reduced interest rates and bond price volatility, generated growth of 6.21%, when compared to 2019.”

Staff cost increase 19% to close at $144.53 million versus $121.15 million recorded for the same quarter of 2019. Impairment losses on financial and other operating expenses increased 360% and 10% respectively, to close the period at $144.53 million (2019: $121.15 million), $40.73 million (2019: $8.86 million) and $162.55 million (2019: $147.34 million) respectively. Management noted, “The increase in expenses was primarily attributable to impairment losses on Financial Assets of $40.73M, recognised in the context of current market conditions. These may be reversed in upcoming periods based on projections from our Expected Credit Loss (ECL) models. Other expenses relate to people development, asset tax and other support services required to grow our business. Nonetheless, the review of our cost structure remains an ongoing exercise.”

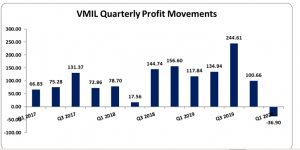

Operating loss for the three months ended March 2020 amounted to $79.44 million versus a profit of $160.69 million for corresponding quarter in 2019. Share of loss in associate for the period under review stood at $9.13 million (2019: nil).

Loss before taxation amounted to $88.56 million for the period, in contrast to a profit of $160.69 million recorded for the first quarter ended March 2019. Tax credited amounted to $51.66 million (2019 tax charge: $42.83 million charged).

Consequently, net loss for the quarter totaled $36.90 million, compared to a profit of $117.86 million booked for the same period in 2019.

Comprehensive loss for the period amounted to $984.55 million relative to an income of $583.24 million reported for the first quarter of 2019.

Loss per share totalled $0.02 (2019: $0.08 EPS) for the period. The twelve-month trailing earnings per share is $0.30. The number of shares used in our calculations 1,500,025,000 units. Notably, VMILs stock price closed the trading period on May 15, 2020 at a price of $7.79.

Management noted, “The Group’s performance was adversely impacted by a reduction in net fees, commissions and gains from investment activities.”

Furthermore, “During the review period we launched our first agile lab geared towards delivering more customer centric solutions. Our investment in digitising the business has allowed us to respond to our clients’ needs during this difficult period. Further digitisation efforts will accelerate in the coming quarters. This initiative will pave the way for a stronger, more resilient, digitised and customer friendly business in the medium term.”

Balance Sheet:

As at March 31, 2020, The Company’s asset base totaled $24.74 billion, 15% up from $21.60 billion as at March 31, 2019. The main contributor to the increase in total assets was ‘Loan Receivables’ and ‘Resale Agreements’ which amounted to $1.98 billion (2019: $769.59 million) $ 2.84 million (2019: $1.74 million), respectively.

Total Stockholders’ Equity as at March 31, 2020 was $3.30 billion (2019: $3.6 billion); resulting in a book value per share of $2.20 (2019: $2.24).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.