November 12, 2021

Wigton Windfarm Limited, for the six months ended September 30, 2021, reported sales of $1.21 billion, an 11% decline on the $1.36 billion reported in the prior year. Revenue for the quarter declined 7% to $572.56 million (2020: $612.85 million). Management noted that, “this change was largely due to (i) the lower level of production, and (ii) the approximate 50% rate reduction in United States dollars terms for Wigton Phase II which had an overall impact on sales revenue in Jamaican dollars of $81.5 million or 12.2%.”

Cost of sales went up 1% to close the period at $417.99 million versus $412.82 million booked in the previous comparable period. As such, gross profit declined to total $791.20 million (2020: $950.92 million). While for the quarter, gross profit amounted to $367.98 million (2020: $407.72 million).

Other income amounted to $76.35 million, a 30% decline when compared to $108.52 million in the same period last year.

General administrative expenses increased for the period amounting to $316.05 million relative to $201.80 million documented in the same period in the previous year. This was “as a result of increased maintenance costs, salaries and insurance premiums. In terms of increased maintenance, a number of these activities were carried over from previous periods due to supply chain delays in spare parts arrival,” as per Management

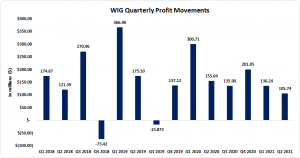

Consequently, operating profit decreased 36%, closing the period under review at $551.50 million (2020: $857.65 million). Operating profit for the quarter totalled $256.29 million (2020: $337.86 million).

Finance expense trended downwards from $257.98 million in 2020 to $233.11 million in 2021, a 10% decrease.

As such, profit before taxation went down by 47% to close at $318.39 million (2020: $599.67 million). After taxation of $76.42 million (2020: $143.92 million), net profit for the period totalled $241.98 million (2020: $455.75 million). Net profit for the quarter closed at $105.74 million versus $155.04 million booked in the similar period last year.

Earnings per share (EPS) was $0.022 for the period compared to $0.041 in 2020. EPS for the quarter amounted to $0.01 (2020: $0.014). The twelve-month trailing EPS amounted to $0.053. The number of shares used in the calculations is 11,000,000,000. WIG stock price closed the trading period on November 12, 2021 at $0.50 with a corresponding P/E of 9.50 times.

WIG noted that, “these decreases were as a result of lower levels of production due mainly to lower wind regime over the period, unavailability of some equipment which were undergoing maintenance and the impact of the rate reduction for Wigton Phase II. While the Company benefited significantly from a front-loaded rate regime in respect of Wigton Phase II and was able to pay down its debts by 10.6% of total project cost for Wigton Phase II and accumulate the 20% equity requirement for Wigton Phase III, the revenue shortfall from the lower rate which took effect during this period should be buttressed through core business initiatives being undertaken by the Company. Accordingly growing the business by investing in new business opportunities, being ready to respond to any new calls for additional renewable energy to the national grid, and continuing to prudently manage major expenses are among the core focus areas of management.”

Management stated, “The average plant availability rate was approximately 87.6% during the six months reporting period. This was below the projected target of 93.3% because of wind turbines being out of operation during the period to facilitate major maintenance activities.”

As at September 30, 2021, Wigton’s total asset base fell 1% to close at $11.04 billion (2020: $11.16 billion). The decrease was as a result of a 6% decline in ‘Property, Plant & Equipment’, which closed the period at 6.70 billion (2020: $$7.12 billion) and 29% decline in ‘Receivables’ to $202.09 million (2020: $283.87 million). However, the decrease was partially tempered by an increase in ‘Cash and Deposits’ which closed $3.98 billion (2020: $3.52 billion).

Shareholders’ Equity amounted to $4.46 billion relative to $3.89 billion in 2020 resulting in a book value per share of $0.41 relative to $0.35 in 2020.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.