February 17, 2020

138SL’s Revenue increased by 110% to $455.24 million relative to the $216.79 million recorded for the corresponding period last year. Other operating income for the period under review rose by 38% to $8.70 million compared to $6.30 million a year earlier.

Administrative expenses increased marginally by 1% to amount to $205.01 million (2018: $203.39 million). Thus, Operating profit closed the period at $258.94 million, a gross increase of 1215% compared to $19.69 million that was reported for the year prior.

The company reported finance cost of $67.68 million (2018: $68.40 million), a 1% decline year over year.

Profit before taxation for the three months period amounted to $191.25 million compared with a loss of $48.71 million last year. Tax charge of $8.39 million was reported for the period (2018 tax credit: $4.87 million)

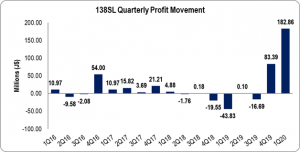

Consequently, net profit totalled $182.86 million compared to a loss of $43.83 million in the prior corresponding period.

The company highlighted that, the Company’s profit, “was positively impacted by a variation claim for 2019, plus a first quarter 2020 claim relating to the construction of Irvine Hall. Adjusting for both variation claims, the group recorded first quarter profit amounting to $33M. The claim for the full 2019 year is a one-off item, while the claim for 2020 is expected to occur each quarter of the current financial year.”

Earnings per share (EPS) for the period was recorded at $0.44 relative to loss per share of $0.11 a year earlier. The twelve-month trailing EPS amounted to $0.60. The number of shares used in this calculation was 414,500,000. As at February 17, 2020, the stock traded at $4.35.

Notably, Management stated, “During the period under review 138 SL operated 1,460 world class rooms at its 4 locations on the UWI Mona Campus consisting of 1,692 beds. As part of its contribution to the welfare of students we offer 18 rooms, free of charge, to Resident Advisors who are charged by UWI to motivate students to participate in campus activities amongst other things. Average occupancy across all three Halls for the quarter was 99%. We expect this level of occupancy to continue up to May 2020 when the summer period begins. 138 SL operations are governed by the Concession Agreement which guarantees a minimum of 90% average occupancy throughout the year.”

Balance Sheet at a Glance:

As at December 31, 2019, Total Assets increased by 26% to $11.15 billion (2018: $8.88 billion). This movement was primarily driven by a 28% increase in ‘Financial asset-service concession’ to close the period at $10.18 billion (2018: $7.94 billion).

Total Shareholders’ Equity’ totalled $5.73 billion (2018: $3.27 billion), which resulted in a book value of $13.82 (2018: $7.90).