December 18, 2020

BANK OF JAMAICA HOLDS POLICY RATE

Bank of Jamaica (BOJ) announces its decision to hold the policy interest rate (the rate offered to deposit-taking institutions on overnight placements with BOJ) unchanged at 0.50 per cent per annum.

Bank of Jamaica has kept the policy rate at this historic low of 0.50 per cent based on its assessment that inflation will generally continue to remain within the target of 4.0 per cent to 6.0 per cent over the next two years, notwithstanding the temporary impact on agricultural prices from the recent rains. This accommodative monetary policy is aimed at supporting a recovery in economic activity. BOJ also proactively implemented a number of initiatives aimed at preserving financial sector stability and ensuring the continued smooth functioning of the foreign exchange market. The economic outlook for Jamaica remains uncertain in the context of the ongoing COVID-19 pandemic but BOJ remains cautiously optimistic as we continue to assess and monitor new developments as they emerge.

Inflation

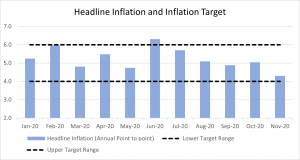

With the exception of the month of June, headline inflation has remained within the target range since the beginning of 2020. Annual headline inflation at November 2020, as reported by the Statistical Institute of Jamaica, declined to 4.3 per cent from 5.0 per cent at October 2020. Underlying or core inflation, which measures the change in prices excluding agricultural food and fuel prices, was 3.4 per cent at November 2020, below the 3.6 per cent at October 2020.

Bank of Jamaica’s current assessment remains broadly in line with our projections communicated in November 2020, that inflation will average 5.3 per cent over the next two years and will, for the most part, track within the target range of 4.0 per cent to 6.0 per cent. This forecast was mainly predicated on expectations for an uptick in agricultural food prices given the flood rains in October and November 2020, higher international commodity prices and expectations for increases in some regulated utility prices. Core inflation was expected to remain relatively low given the weak demand conditions in Jamaica.

The risks to the inflation forecast are balanced. Factors that could cause the inflation rate to be higher than forecasted include:

(i) higher than anticipated inflationary pressures from food prices over the next three months; and

(ii) stronger than anticipated increases in international oil and grains prices.

However, inflation could be lower than forecasted if demand conditions are weaker than projected.

Economic Activity

Bank of Jamaica is forecasting a contraction in the economy in the range of 10.0 per cent to 12.0 per cent in FY2020/21 before partially recovering within the range of 3.0 per cent to 6.0 per cent in FY2021/22. The projected decline in real GDP in FY2020/21 is expected to be mainly reflected in Hotels & Restaurants, Transport, Storage & Communication, Other Services, Manufacturing and Construction. These expected declines are largely based on the adverse impact of the global COVID-19 pandemic on travel, production, distribution and entertainment activities.

The Bank’s current assessment suggests that the risks to the GDP forecast are skewed to the downside, which implies that the recovery in GDP over the next two years could be slower than expected. The main reason for this assessment is the continued adverse impact of COVID-19 on economic activity. However, on the upside, there is the possibility of a faster than expected pace of recovery in the economy if the COVID-19 pandemic is effectively contained or a vaccine becomes widely available.

Monetary Policy

The heightened challenges associated with the COVID-19 outbreak remain an ongoing concern and Bank of Jamaica has maintained an accommodative monetary policy stance aimed at supporting a speedy economic recovery once this crisis has passed. Bank of Jamaica remains committed to ensuring that inflation remains low and stable, within its target and, at the same time, is prepared to take all necessary actions to ensure that Jamaica’s financial system remains sound. The Bank intends to maintain this monetary policy stance until there are clear signs that economic activity in Jamaica is returning to pre-COVID-19 levels.

The next policy decision announcement date is 16 February 2021.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.