November 13, 2020

Carreras Limited (CAR)

Financial Statements for the Six Months Ended September 30, 2020:

Carreras Limited, for the six months ended September 30, 2020, reported Operating Revenue of $6.15 billion, a 7% decline relative to $6.64 billion booked in 2019. Revenue for the quarter closed at $3.46 billion, compared to $3.19 billion reported for the second quarter of 2019. The company highlighted that, “Our performance in quarter two was mainly driven by the steadfast commitment of the team to recover from the difficult first quarter of 2020, influenced by the myriad of COVID-19 restrictions.”

Cost of Operating Revenue also fell year over year by 6%, amounting to $3.13 billion from $3.34 billion. As such, Gross Operating Profit fell by 9% to total $3.03 billion relative to the $3.31 billion in 2019. Operating profit for the quarter amounted to $1.70 billion relative to $1.58 billion booked for the same quarter of 2019. Other Operating Income rose 38% moving from $32.24 million in 2019 to $44.51 million.

Administrative, distribution and marketing expenses increased 4% to total $999.02 million (2019: $1.03 billion). Management stated, “The company continues to focus on improvements to our cost base and continues to maximize benefits in the rout-to-market distribution network as well as significant decreases in related part costs. These combined to positively impact our business performance, and management remains committed to implementing further cost efficiencies while continuing to invest in our most valuable assets: Our brands and our people.”

Interest income for the period amounted to $23.73 million, a 31% decline from the $34.21 million booked in 2019. Interest expense for the six month period closed at $9.66 million relative to $5.64 million in 2019.

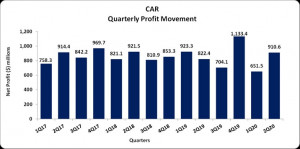

Profit before Income Tax closed the period at $2.09 billion relative to $2.34 billion in 2019. Taxation of $530.52 million was incurred for the period (2019: $590.60 million). Consequently, Net Profit for the six months decreased to $1.56 billion relative to $1.75 billion booked in 2019. Net profit for the quarter increased to $910.63 million versus $822.41 million booked for the second quarter of 2019.

The Earnings per share (EPS) for the period was $0.32 compared to $0.36 for the corresponding period of last year. EPS for the quarter amounted to $0.19 (2019: $0.17). The twelve-month trailing EPS amounted to $0.70. The number of shares used in the computations amounted to 4,854,400,000 units. CAR’s stock price last traded on November 12, 2020 at $6.60.

CAR also noted that, “The pandemic is here for the medium term and we are ready to fulfil the mandate of the shareholders in delivering value in a most sustainable fashion. We are driven by the passion of our team, and our strong working relationship with the 10,000 valid outlets that sell our products across the island. Our confidence that Jamaica will emerge stronger from the unprecedented crisis gathered steam daily, ad therefor Carreras remains optimistic in our outlook for the business.”

Balance Sheet Highlights:

Total Assets amounted to $4.29 billion as at September 30, 2020, up from $3.81 billion reported in 2019. This was mainly due to an increase in Account receivable which closed at $1.26 billion in contrast to $915.98 million as at September 30, 2020.

Shareholders’ Equity attributable to stockholders of parent amounted $1.78 billion (2019: $1.53 billion) with book value per share of $0.37 (2019: $0.32).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.