April 26,2018

Caribbean Cement Company Limited (CCC) for the three months ended march 31, 2018 reported total revenue for the three months ended March 31, 2018 grew by 6% amounting to $4.34 billion, up from $4.09 billion reported a year ago.

Earnings before interest, tax, depreciation & amortization (EBITDA) for the period amounted to $605.96 million, a decline of 11% relative to $684.34 million booked for the prior year’s corresponding period. CCC noted this, “This performance was mainly driven as a result of the scheduled annual maintenance of Kiln 5 and Mill 5, performed during February and March of 2018. Our investment in maintenance efforts will no doubt increase our operational efficiencies with the goal of driving exports, in due course.”

Depreciation and amortization closed the period at $126.19 million (2017: $134.17 million). As a result, operating profit totaled approximately $479.78 million (2017: $550.17 million) for the period, a decline of 13% year over year.

Interest Income for the three months ended amounted to $4.88 million, a gross increase of 165% when compared to $1.84 million for the corresponding period in 2017. Finance Income for the three months closed at $25.80 million compared to a finance cost of $24.16 million incurred for the corresponding period of 2017.

Consequently, Profit before Taxation for the period amounted to $510.45 million, 3% less when compared with a profit of $527.85 million recorded last year. Taxation for the period increased 161% from $67.48 million reported for the first three month of 2017 to $176.13 million.

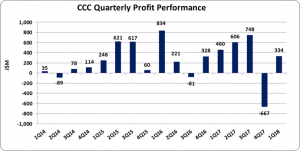

Net profit for the first quarter closed at $334.32 million relative to net profit of $460.36 billion booked for the corresponding quarter in 2017, a decrease of 27% year over year.

Total comprehensive income for the period closed at $347.81 million, relative to $460.36 million for the corresponding period in 2017.

Consequently, earnings per share (EPS) amounted to $0.39 (2017: $0.54), while twelve months trailing EPS is $1.20. The number of shares used in this calculation was 851,136,591 shares. CCC stock price closed the trading period at a price of $38.97 on April 25, 2018.

CCC highlighted, “The Board of Directors and Management of Carib Cement are pleased to report that the agreement with our parent company Trinidad Cement Limited (TCL), for the acquisition of Kiln 5 and Mill 5 has been signed, thereby terminating the lease agreement. The initial payment of $1.3 billion towards the acquisition represents a significant investment in plant and equipment, improving the company’s asset base. This is proof that Carib Cement remains committed to achieving success and continues to strive to live up to its slogan of ‘Building a Greater Jamaica”

Lastly, management indicated, “The coal mill project is currently in the final stages and production is expected by the end of the third quarter of this year. This will continue to contribute to the plant’s operational efficiency and also to a reduction in operating costs.”

Balance sheet at a Glance:

Total Assets grew by $1.84 billion or 17% to close at $12.91 billion as at March 31, 2018 (2017: $11.07 billion). This increase in total assets was largely due to the $2.86 billion increase in ‘Property, Plant and Equipment’ which closed at $9.63 billion (2017: $6.76 billion). Cash and Cash Equivalents also contributed to this increase with a 93% increase year over year to $1.05 billion (2017: $544.43 million).

Shareholder’s equity totaled $9.30 billion compared to the $8.20 billion quoted as at March 30, 2017. This resulted in a book value of $10.93 (2017: $9.63).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.