Date: February 15, 2019

In United States dollars (except where it is indicated otherwise):

Caribbean Producers Jamaica Limited (CPJ) for the six months ended December 31, 2018,Revenues declined marginally by 0.3% from $53.91 million, to close the period at $53.73 million compared to the prior year. For the second quarter, the company also posted a 0.4% decline in revenues to close at $29.42 million relative to $29.54 million for the same quarter of 2017. CPJ noted that, “The Group retuned to normalcy of operations with strong revenue in Q2 and a return to profit. The increase in revenue for the quarter by US $5.1 M (21%) above Q1 and on par with Q2 of the prior year at US$29.5 M. The Company delivered a strong profit recovery of US$484K in the month of December 2018.” Management also noted, “Revenue from protein sales to hotels decreased due to inequitable competition based on their mistreatment of applicable duties and taxes. This represented a decline in the category for the period of US$1.3M or 19.4% when compared to same period prior year. However, given CPJ’s diverse product portfolio, aggressive sales push in order categories resulted in strong growth for seafood (28.6%), spirits (21.1%) and RTD Beverages (13%) to offset the decline.

Cost of goods sold showed a 2% increase closing the period at $40.26 million relative to $39.52 million for the corresponding period in 2017. For the quarter, the company recorded a 3% increase in cost of goods sold to close at $22.29 million relative to $21.70 million for the comparable period in 2017.

Consequently, CPJ recorded a decline in gross profits to $13.47 million (2017: $14.39 million). Gross profits for the quarter also declined from $7.84 million in 2017 to $7.13 million.

Selling and administrative expenses were $11.69 million, a 12% increase on the $10.46 million posted for the prior year. Depreciation for the period fell by 3% closing the period at $1.21 million (2017: $1.25 million).

Other operating income totaled $98.72 million; this compares with an operating income of $31,813 booked in 2017.

The company booked a loss before finance costs, income and taxation of total $226,327 relative to a profit $2.65 million in 2017.

Finance costs amounted to $800,794 (2017: $849,205). Finance income improved 37% to close at $278 (2017: $203). As such loss before taxation was $1.03 million compared to a profit of $1.80 million in 2017.

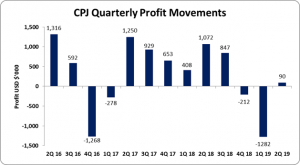

Net loss for the six months amounted to $1.13 million relative to a profit of $1.62 million in 2017. While for the quarter, net profit amounted to $164,722 relative to a net profit $1.18 million booked last year.

Net loss attributable to shareholders for the six months amounted to $1.19 million relative to a profit of $1.46 million in 2017. While for the quarter, net profit attributable to shareholders amounted to $89,874 relative to a net profit $1.07million booked last year.

As a result, loss per share (LPS) for the six months amounted to US0.11 cents compared to an earnings per share of US0.13 cents in 2017. EPS for the quarter amounted to US0.01 cents relative to US0.11 cents. The twelve months trailing earnings per share amounted to US$0.05. The number of shares used in our calculations amounted to 1,100,000,000 units. CPJ closed trading on February 14, 2019, at J$4.74.

CPJ stated the following:

- “Management is of the view that the disruptive impact of the IT implementation project is now contained in Q2. The objective for the second half of the year is to continue the recovery towards profitability after significant extraordinary impact from Q1 business disruption. Specifically, focus to address the impact on the loss of the market share in protein business during Q3 and Q4 and reserve the correlated impact on the gross profit. The core business remains strong and robust and anticipates the growth in its sales trajectory will continue as planned.”

- “The major project that was announced for the Fiscal Year the construction of the new 56,000 square foot distribution facility will be formally opened on February 12, 2019. The other project that was announced was expansion of the CPJ St. Lucia into retail market. The first CPJ retail store in St. Lucia was opened to the public on the 15th December 2018 and it has been well received by the people of St. Lucia.”

- “The new Distribution center is being viewed as a game changer for CPJ and the most significant event in its 25th anniversary year. It is expected that the company will benefit from significant improvements in achieving operational efficiency, greater customer satisfaction and reduction in direct fulfillment costs and overall contribute towards value creation for its shareholders.”

Balance Sheet Highlights:

As at December 31, 2018, CPJ’s total assets amounted to $65.32 million, a 7% increase from the $61.23 million booked in 2017. This resulted from the increase in ‘Short-terms loans’ and ‘Accounts payables’ by 81% and 27% respectively.

Shareholder’s Equity totaled $22.31 million (2016: $22.87 million) resulting in a book value per share of approximately US2.03cents (2017: US2.08 cents).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.