November 17, 2020

For the first quarter ended September 30, 2020:-

Figures are quoted in United States dollars (except where it is indicated otherwise):

Caribbean Producers Jamaica Limited (CPJ), for the first three months ended September 30, 2020 reported that revenues decreased by 65%, to close the period at $9.35 million compared to the $27.08 million for the same period last year.

Cost of operating revenue fell by 66%, closing the period at $6.92 million relative to $20.31 million for the same period last year. This resulted in gross profits contracting by 64% to total $2.43 million relative to $6.77 million in 2019.

Selling and distribution expenses were $2.87 million relative to the $5.90 million posted last year. Depreciation for the period rose by 40% closing the period at $1.07 million (2019: $766,543).

Other operating income totalled $31,401 compared with the $50,420 booked the previous year.

Thus, Loss before finance costs, income and taxation totalled $1.51 million relative to a profit of $137,852 in 2019.

Finance costs was $438,709 versus $455,524 in 2019, a 4% decrease while finance income rose significantly to $8,388 (2019: $276). Loss before taxation amounted to $1.94 million compared to a loss of $317,396 in 2019.

No taxes were charged for the period under review hence net loss for the period amounted to $1.94 million relative to a loss of $317,396 in 2019.

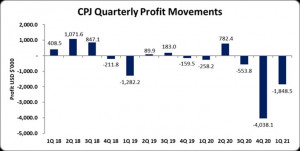

Loss Attributable to shareholders ended the period at $1.85 million relative to a loss of $258,201 in 2019.

As a result, loss per share for the period amounted to US0.17 cents (2019: LPS US0.023 cents), while the twelve-month trailing LPS totalled US0.514 cents. The stock price closed November 16, 2020 at JMD$2.35. The number of shares used in our calculations amounted to 1,100,000,000 units.

CPJ further noted, “The easing of the travel restrictions and a willingness to travel has seen increased tourism activity both onshore and offshore. This has increased the demand for CPJ’s products and services in the first few months of the fiscal year 2021. The Group is prepared for a full recovery’ of the travel industry. It remains committed to its strategic goal of achieving long-term shareholder value by creating scale and implementing strategic business transformation initiatives.”

Balance Sheet at a glance:

As at September 30, 2020, total assets amounted to $56.38 million, 11% less than its value of $63.48 million booked a year ago. According to the Company, “The Group continues to demonstrate strong treasury management during these difficult times with a current asset to current liability ratio of 2.62:1 compared to 2.20:1 in the same period last year.”

Shareholder’s Equity as at September 30, 2020, totalled $16.06 million (2019: $21.72 million) resulting in a book value per share of approximately US1.460 cents (2019: US1.974 cents).

Disclaimer:

Analyst Certification –This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.