August 15, 2022

Dolphin Cove Limited (DCOVE), for the six months ended June 30, 2022 reported total revenue of US$6.76 million, a 135% increase when compared to US$2.87 million booked the year prior. Revenue from dolphin attraction contributed US$3.46 million to total revenue, a 140% uptick when compared to the US$1.44 million reported in 2021, while revenues from the ancillary services totalled US$3.30 million, a 131% increase from last year’s US$1.43 million. DCOVE noted, “We welcomed 120% more visitors than in Q2-2021. Our attendance YTD was 23% below Q2-2019 (in pre-pandemic times) but for Q2 attendance was 3% greater than for Q2-2019 and revenue was 6% greater. In terms of LTM figures up to June 30, 2022, the revenue increased 2.5 times. Revenue per visitor YTD increased 12% compared to pre-pandemic times.”

Total revenue for the quarter amounted to US$4.19 million (2021: US$2.13 million), with Dolphin Attraction and Ancillary Service contributing US$2.14 million and US$2.05 million respectively.

Direct costs of sales for the period totalled US$643,939, 83% more than the US$352,733 reported in 2021. As such, gross profit for the six months amounted to US$6.11 million (2021: US$2.52 million). DCOVE for the second quarter booked net revenue of US$3.82 million relative to 2021’s gross profit of US$1.92 million.

Other income for the period contracted by 73% to US$40,156 compared to US$147,100 a year earlier.

Total operating expenses for the six months rose, moving to US$3.65 million from US$1.62 million in 2021. Of this:

- Selling expenses grew by 230% to total US$1.36 million relative to US$411,602 in 2021.

- Other operations totalled US$1.71 million, 67% more than the US$1.02 million recorded the prior year.

- Administrative expenses surged by 210% to total US$582,511 compared to US$188,079 in the corresponding period last year.

Finance income fell by 83% totalling US$37,611 relative to US$215,023 last year. The company’s finance cost declined by 40% from US$143,539 for the same period in 2021 to US$86,823 in 2022.

Profit before tax totalled US$2.45 million relative to profit before tax of US$1.12 million in 2021. Tax charges for the period were US$613,111 (2021: US$32,403).

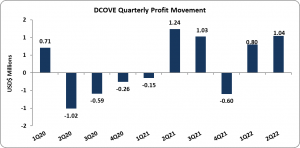

Profit for the period was US$1.84 million relative to net profit of US$1.08 million booked the prior year. Profit for the second quarter ended at US$1.04 million up from a profit of US$1.24 million for the six months ended June 2021. According to management, “YTD profit increase was also due to management of our costs and expenses, as during Q2 the Company spent 29% less than in pre-pandemic Q2-2019, due to some efficiencies that were put in place in 2020. The net profit at the end of Q2-2022 was also 7% greater than pre-pandemic Q2-2019.”

Earnings per stock unit for the six months totalled US$0.0047 (J$0.71) relative to EPS of US$0.0028 (J$0.41) in 2021. While EPS for the quarter amounted to US$0.0027 (J$0.40) relative to EPS of US$0.0032 (J$0.47) in 2021. The trailing twelve months EPS amounted to US$0.006 (J$0.88). DCOVE’s stock last traded on August 12, 2022 at $14.78 with a corresponding P/E ratio of 16.87 times.

Balance Sheet Highlights:

The company’s assets totalled US$33.10 million, 9% greater than the US$30.24 million reported as at June 30, 2021. This was as a result of a 164% increase ‘Cash and cash equivalents’ and ‘Taxation recoverable’ which closed the period at US$3.18 million (2021: US$1.21 million) and US$710,680 (2021: US$323,376) respectively.

The company closed the financial period with shareholders’ equity in the amount of US$28.01 million (2021: US$27.74 million). The company now has a book value per share of US$0.071 (2021: US$0.071).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.