November 15, 2021

Expressed in United States Dollars unless otherwise stated

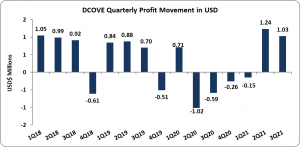

Dolphin Cove Limited (DCOVE), for the nine months ended September 30, 2021 reported total revenue of US$5.44 million, a 51% increase when compared to US$3.61 million booked the year prior. Total revenue for the quarter amounted to US$2.57 million (2020: US$319,754). According to the company, “The company made a profit of US$1 million in Q3 2021. This performance was achieved through our commercial strategies to reach out to a considerable number of guests and our experience in the market by creating synergies between our parks and keeping our expenses under strict control. Despite the imposition of “no movement days” by the government, which caused a reduction in operating capacity, Dolphin Cove welcomed nearly 30,000 guests and generated sales of $2.3 million. This demonstrates our resilience and capacity to deliver great financial results even under the current trying circumstances.”

Revenue from Dolphin Attraction contributed US$2.71 million to total revenue; this represents a 39% increase when compared to the US$1.95 million reported in the prior year. Revenues from the Ancillary Services totalled US$2.74 million, a 65% increase from last year’s US$1.66 million.

Total direct cost for the period totalled US$620,969, a 14% reduction from the US$725,210 reported in 2020.

Gross profit for the period grew by 67%, to US$4.82 million relative to 2020’s total of US$2.88 million, while for the quarter gross profits closed at US$2.30 million, relative to the US$153,510 reported in of the prior period. Other income for the nine month period amounted to US$208,967 relative to the US$151,795 of last year.

Total operating expenses saw a decrease of 17%, moving from US$3.53 million in 2020 to US$2.93 million. This decrease was primarily due to:

A US$418,123 decrease in other operating expenses which closed at US$1.69 million (2020: US$2.11 million).

The 22% decline in selling expense which amounted to US$555,952 (2020: US$716,015).

Administrative expense on the other hand declined by 2% to US$684,198 (2020: US$699,841).

For the third quarter total expenses rose by 139% to US$1.31 million (2020: US$548,124).

Finance income grew by 186%, totalling US$295,543 relative to US$103,198 last year, while finance cost increased from US$96,294 in 2020 to US$215,442.

Profit before taxation amounted to US$2.18 million relative to the loss before tax of US$484,117 booked the prior year. For the quarter, profit before taxation closed at US$1.06 million compared to loss before taxation of US$348,813 twelve months earlier.

After taxes of US$64,806 (2020: US$379,798), Net profit for the period was US$2.11 million compared to net loss of US$863,915 booked the prior year. Net profit for the quarter amounted to US$1.03 million when compared to net loss of US$590,475 reported in 2020.

Earnings per stock unit for the nine months totalled US$0.0054 relative to loss per stock unit of US$0.0022 in 2020. EPS for the quarter amounted to US$0.0026 relative to LPS of US$0.0015 in 2020. The trailing twelve-month EPS amounted to US$0.005. The number of shares used in the calculation was 392,426,376 units. The stock traded at J$10.10 as at November 12, 2021 with a corresponding P/E ratio of 14.58 times.

DCOVE noted: “After 16 months of pause, the Cruise Line Industry resumed operations in Jamaica on August 16th, with the arrival of the Carnival Sunrise ship at the port of Ocho Rios and, on September 21st, MSC Cruise Lines also resumed operations in Jamaica. Within Q3, Jamaica received 6 arrivals of cruises and Dolphin Cove hosted nearly 1,000 guests from cruise ships. We expect to have a gradual increase in the arrivals in the following 6 months and, as of the date of signing this report, we have 46 calls confirmed for Q4 2021.”

Balance Sheet Highlights:

As at September 30, 2021, the company’s assets totalled US$33.02 million, 7% more than the US$30.79 million reported as at September 30, 2020. This was as a result of an increase in ‘Cash and cash equivalents’ which totalled US$2.03 million (2020: US$472,650).

The company further added, “The Group continues to show a solid net assets base and strong balance sheet. The working capital increased by 150% over the level at December 2020.”

The company closed the financial period with shareholders’ equity in the amount of US$28.77 million (2020: US$26.93 million) which resulted in a book value per share of US$0.073 or JMD$10.80 (2020: US$0.069, JMD$9.75).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.