August 16, 2021

Expressed in United States Dollars unless otherwise stated

Dolphin Cove Limited (DCOVE), for the six months ended June 30, 2021 reported total revenue of US$2.87 million, a 13% decrease when compared to US$3.29 million booked the year prior. Revenue from dolphin attraction contributed US$1.44 million to total revenue, a 19% fall off when compared to the US$1.79 million reported in 2020, while revenues from the ancillary services totalled US$1.43 million, a 5% decrease from last year’s US$1.50 million. Total revenue for the quarter amounted to US$2.13 million (2020: nil), with Dolphin Attraction and Ancillary Service contributing US$1.07 million and US$1.06 million respectively. DCOVE noted, “Despite continuing to operate in a highly challenging and COVID-19 impacted environment, the Company delivered strong second quarter 2021 financial results. Our commercial strategies were focused on generating as much sales as possible from the greater tourism traffic to Jamaica within the three months and our parks continued to benefit from the local market.”

Direct costs of sales for the period totalled US$352,733, 36% less than the US$555,076 reported in 2020. As such, net revenue for the six months amounted to US$2.52 million (2020: US$2.73 million). DCOVE for the second quarter booked net revenue of US$1.92 million relative to 2020’s net loss of US$153,427.

Other income for the period rose by 36% to US$147,100 compared to US$108,155 a year earlier. While gain on disposal of PPE amounted to US$199 (2020: nil).

Total operating expenses for the six months decreased, moving to US$1.62 million from US$2.98 million in 2020. Of this:

Selling expenses fell by 76% to total US$188,079 relative to US$770,447 in 2020.

Other operations totalled US$1.02 million, 37% less than US$1.64 million recorded the prior year.

Administrative expenses dipped by 28% to total US$411,602 compared to US$572,455 in the corresponding period last year.

Finance income increased by 235% totalling US$215,023 relative to US$64,210 last year. The company’s finance cost increased by 141% from US$59,464 for the same period in 2020 to US$143,539 in 2021.

Profit before tax totalled US$1.12 million relative to loss before tax of US$135,302 in 2020. Tax charges for the period were US$32,403 (2020: US$138,138).

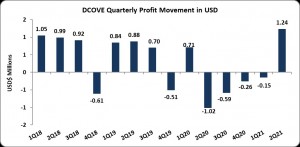

Profit for the period was US$1.08 million relative to net loss of US$273,441 booked the prior year. Profit for the second quarter ended at US$1.24 million up from a loss of US$1.02 million for the six months ended June 2020.

Earnings per stock unit for the six months totalled US$0.0028 (J$0.41) relative to LPS of US$0.0007 (J$0.10) in 2020. While EPS for the quarter amounted to US$0.0032 (J$0.47) relative to LPS of US$0.0026 (J$0.36) in 2020. The trailing twelve months EPS amounted to US$0.001 (J$0.09). DCOVE’s stock last traded on August 13, 2021 at $8.00 with a corresponding P/E ratio of 92.94 times.

DCOVE noted, “Even within Q2 2021, the operations of the Company were still affected by restrictions derived from the sanitary requirements and restrictions, such as capacity limitations and reduced operating hours/days in all the parks. The focus of the management has been to ensure that the parks maintain a slim and controlled operation sufficient to provide a high-quality service to our guests and maintaining the well-being of our staff members and the animals under our care.”

Balance Sheet Highlights:

The company’s assets totalled US$31.89 million, 2% greater than the US$31.23 million reported as at June 30, 2020. This was as a result of a 20% increase ‘Accounts receivable’ and ‘Trade receivables which closed the period at US$1.57 million (2020: US$1.31 million) and US$953,991 (2020: US$737,135) respectively.

The company closed the financial period with shareholders’ equity in the amount of US$27.74 million (2020: US$27.52 million). The company now has a book value per share of US$0.071 (2020: US$0.070).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.