January 15, 2020

Express Catering Limited (ECL) for the six months ended November 30, 2019 reported a 9% increase in revenue to US$7.81 million (2018: US$7.18 million). Revenue for the quarter advanced 5% to close at $3.28 million relative to $3.12 million reported the previous year. According to Management, “This is quite favourable, with the airport operators reporting flat departing passenger number for the quarter when compared to the prior year. We constantly benchmark our minimum growth target to be within the rate of passenger growth.” The company added, “ Departing passenger numbers for the 6 months increased by just over 1%.”

Cost of sales (COS) increased by 10% for the period to US$2.13 million (2018: US$1.93 million). As a result gross profit increased year-on-year for the six month period by 8%, from US$5.25 million in 2018 to US$5.68 million in 2019. Gross profit for the second quarter improved from US$2.28 million in 2018 to US$2.38 million for the six months ended November 30, 2019.

ECL noted, “Cost of Sales had marginal changes for the Quarter and YTD and was in an acceptable range. Variations in the product mix along with changes in the product category composition will result in marginal changes. Administration and general expenses were, for the most part, in the line with prior period ratios. The increase in maintenance cost midway in the prior half year distorted the comparison and resulted in a marginal increase in current year expense ratio.”

Furthermore, Management noted that, “ the Company will be making a dividend payment on January 15, 2020.”

Other income grew by 27% to close the period at US$173 versus $136 booked in the previous corresponding period. For the quarter, ECL posted other loss of US$7,364 versus other income of US$33 recorded in the prior comparable quarter.

Total expenses increased by 9% for the period in review to US$3.97 million for 2019, up from US$3.64 million booked for the six months ended November 30, 2018. This increase was associated with a 9% increase in administrative expenses to US$3.63 million from US$3.33 million in the six months ended November 30, 2018. Depreciation and Amortization saw an 8% jump to US$306,929 compared to US$285,454 for 2018. Promotional expenses saw a 33% increase from US$23,017 in 2018 to US$30,668 documented in the period under review. Total expenses for the quarter rose 4% to close at US$1.77 million (2018: $1.70 million).

Consequently, operating profit increased by 7% to US$1.71 million (2018: US$1.61 million). Operating profit for the quarter totalled US$602,996 a 4% rise relative to US$579,119 booked for the corresponding quarter of 2018.

Finance cost of US$160,064 (2018: US$169,838) was incurred, while foreign exchange loss for the six months amounted to US$20,588 compared to a loss of US$16,917 for the corresponding period in 2018.

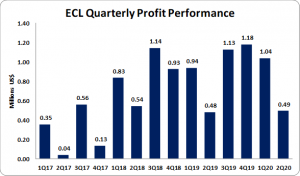

There was no tax incurred, as such, profit for the period amounted to US$1.53 million, 8% above the US$1.42 million recorded for the first six months of 2018. For the quarter, net profit amounted to US$493,415 versus US$481,317 booked for the comparable period in 2018.

The twelve-month earnings-per-share was US0.235 cents, while for first six month ended November 2019, EPS amounted to US0.094 cents (2018: US0.087 cents). Earnings per share for the quarter amounted to US0.030 cents (2018: US0.029 cents). The number of shares used in our calculations was 1,637,500,000. ECL stock price last traded on January 14, 2020 at $6.25.

Balance Sheet Highlights:

The company, as at November 30, 2019, recorded total assets of US$9.98 million (2018: US$6.69 million). This increase was attributable to an increase in ‘Owings by related companies’ from US$212,207 to US$3.81 million in 2019 as well as an increase of ‘Cash and bank balances’ to close at US$309,904 from $93,041 in 2018. The increase was tempered by a reduction in ‘Property, plant and equipment’ which amounted to US$4.20 million as at November 30, 2019 (2018: US$4.48 million) as well as ‘Trade and other receivables’ which totalled US$247,534 million (2018: US$536,736).

Total Stockholders’ equity as at November 30, 2019, closed at US$4.75 million (2018: $1.90 million); this resulted in a book value of US$0.29 cents (2018: US$0.12 cents).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.