September 22, 2021

Outlook

The coronavirus disease (COVID-19) pandemic has had a devastating impact on the global economy by managing to derail some of the hard-won fiscal gains made over time. Global prospects remain highly uncertain due to new virus mutations and rising human toll, even as vaccination efforts improve. The way forward depends on the outcome of the battle between the virus and vaccines and the effective policies implemented to limit lasting damage from this unprecedented crisis.

The Jamaican economy contracted for its fifth consecutive quarter in Q1 2021 as value added continued to taper off in the first three months ended March 2021. The current momentum remains downbeat despite the Planning Institute of Jamaica (PIOJ) estimating growth of 12.9% for Q2 2021, a vast improvement based on the level of activity for the same quarter of 2020. The improved performance in the second quarter reflected the following:

- Increased domestic and external demand for Jamaica’s goods and services,

- Consequent on relaxation of COVID-19 measures due mainly to the increased roll-out of vaccination efforts globally.

- Increased operating hours for businesses which facilitated higher capacity utilization rates and production levels;

- An increase in the implementation of residential and commercial building projects and road construction works;

- Improved weather conditions, which facilitated growth in the Agriculture and Electricity & Water Supply industries;

- Higher levels of employment relative to the closure of businesses and layoffs caused by the lockdown in the corresponding quarter of 2020;

- Higher levels of Business confidence associated with the prospects for strengthened economic outturn in the short to medium term.

One of the hardest hit industries since the onset of the pandemic is Tourism. Recently, the industry was hit with a series of lockdowns, imposed in late August. Additionally, the U.S. government recently advised against travel to the country, at the cost of Jamaica’s tourism industry as the country battles its third wave of Covid-19. This comes off the cusp of an improved summer for players in the industry as measures were relaxed. Tourists arrivals as at the end of June 2021 improved relative to June 2020, but were down 60% compared to 2019, as protocols, measures, and tightened curfews continue to restrict activity within the industry.

Prospects for the remainder of the year appear to be dim as the latest Covid-19 variants (Delta and Mu) have shown up in the island’s third wave. With the travel advisory against Jamaica and the current measures imposed, it is expected that the outlook for the economy will remain clouded by ongoing uncertainty and slow vaccination progress. The economic recovery going forward may be slow as IMF projects growth of just 1.5% for 2021. Looking ahead of 2021, The Bank of Jamaica projects GDP growth within a range of 2% – 4% for FY2022/23.

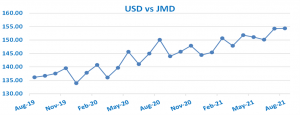

Foreign Exchange

The Jamaica dollar appreciated against the USD for the month of August 2021. The JMD depreciated by $0.06 in August, to close the month at an average of $154.33 relative to the $154.27 recorded in July 2021. Year over year, the JMD has depreciated by approximately $9.31 or 6.42% relative to the $144.96 reported as at July 2020.

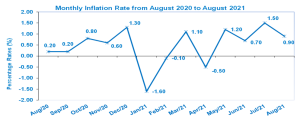

Inflation

The consumer price index for August 2021 was 112.3 resulting in an inflation rate of 0.9% when compared to the previous month’s inflation rate of 1.5%. STATIN noted that, “This movement was primarily due to the 1.8% increase in the index for the heavily weighted ‘Food and Non-Alcoholic Beverages’ division. The index for the class ‘Vegetables, tubers, plantains, cooking bananas and pulses’ rose by 4.4% as prices continued to increase for some agricultural produce such as yam, tomato and sweet pepper.”

The movement in the index for calendar year-to-date was 4.7% and the point- to-point was 6.1% as at August 2021. The Greater Kingston Metropolitan reported inflation of 0.8%, while the Rural Areas and Other Urban Centres both reported inflation of 0.9%.

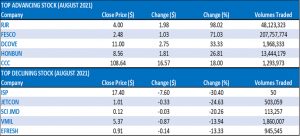

Market Performance

As at the end of August 2021, the JSE’s Main Market index fell 1.48% from its value at the end of July 2021, whilst the Junior Market fell 0.004% over the same period as the market reflected the tightened measures implemented in August to combat the country’s third wave of Covid-19. The JSE Main Market Index contracted by 6,270.10 points from 424,135.01 points to 417,864.91 points at the end of August 2021. The Junior Market index at the end of August 2021 was 3,308.60 points compared to 3,322.77 points recorded at the end of July 2021. Year to date, both the Main Market Index and the Junior Market Index rose 5.62% and 25.17% respectively. As it relates to stock performances, Radio Jamaica Ltd was the big winner during the month, with a 98.02% appreciation in its share price, while Vitoria Mutual Investments Limited was the biggest loser on the Main Market for the month of August. For the Junior Market, ISP Financial Services was the biggest loser for the month with a reported 30.40% decline in its share price. Future Energy Source Company and Dolphin Cove were the other best-performing stocks on the Junior Market during the month of August. In August the U.S. equity indexes hit new highs, the S&P 500 has climbed higher for seven straight months, its longest winning streak since January 2018. Inflation concerns, supply-chain constraints, labor shortages and the spread of the coronavirus Delta variant were not enough to keep the markets down.

Stock Recommendations

WIG: Wigton has been positioning to go after energy contracts in both Jamaica and overseas. The company also anticipates a call for renewable energy in the near term given that the Ministry of Science, Energy and Technology (MSET) has indicated that the Integrated Resource Plan will target more than 500MW of capacity to the national grid to be procured by 2025. Wigton remains ready to respond with proposals to develop utility scale projects for connectivity to the national grid. Recommendation: (Long-term buy)

SVL: The Group has made strides on acquisition to produce inorganic growth, expand brand recognition and maintain market leadership despite new entrants into the market. SVL has expanded its footprint in South Africa and has acquired 51% stake in a microfinance provider, Mckayla Financials to lend to its extensive network of merchants and consumers. These strategic moves are expected to significantly boost the Group’s earning potential over the long term. Recommendation: (Buy)

LUMBER: For the first quarter ended July 31, 2021, the company reported revenue of $420.08 million, an increase of 16% year over year. LUMBER noted, “the strong financial performance during the first quarter was directly related to successful efforts to negotiate adequate stock levels and reasonable cost prices for all key hardware items while maintaining fair selling prices to the market. Recommendation: (Hold)

PAL: Palace Amusement is among the companies whose operation has been hit the hardest by COVID 19 containment measures. The company, which operates four movie theatres and a drive-in, has not been able to sufficiently recover from the novel coronavirus pandemic. Additionally, the measures implemented to combat the spread of COVID-19 impacts their screening schedule, while its patrons’ pockets continue to be hard hit as unemployment inches up with lower disposable income. Recommendation: (Sell)

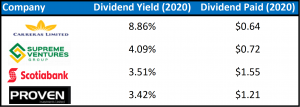

Dividend-Paying Stocks

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.