October 9, 2020

The European Union labour market during the second quarter slack up to 14%, and there was a sharp decline in worked hours. Eurostat noted that “Throughout the second quarter of 2020, the labour market across the European Union (EU) was affected by COVID-19 measures taken by the Member States. Employment and unemployment, as defined by the International Labour Organisation (ILO) concept, are, in this particular situation, not sufficient to describe all the developments taking place in the labour market. In this phase of the crisis, active measures to contain employment losses led to temporary absences from work rather than dismissals. In addition, individuals could not search for work or were not available due to the containment measures, thus not counting as unemployed according to the ILO concept.”

Additionally, the Eurostat published seasonally adjusted quarterly indicators which best illustrate the most recent movement on the labour market in the EU Member States. This adjustment comprises of “total labour market slack, which comprises all persons who have an unmet need for employment, absences from work as well as an index of total actual hours worked in the main job. More new indicators on recent job leavers and starters, weekly total absences, as well as transitions, are available in the Eurostat database.”

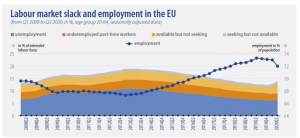

As a result, it was found that the labour market gap increased by 1.2 percentage points and employment went down by 1 percentage point In the second quarter of 2020 to 187.3 million employed persons in the EU. Eurostat stated, “The EU seasonally adjusted employment rate for people aged 20-64 stood at 72.0%, down by 1.0 pp from 73.0% in the first quarter 2020. This has been the sharpest quarter-on-quarter decline since the beginning of the time series in 2000. 13.1 million persons were unemployed.” However, it has gotten worse in the second quarter as the labour force increased to 29.6 million person. Eurostat reported, “the EU seasonally adjusted unemployment rate was 6.5%, up from 6.3% in the first quarter 2020. At the same time, seasonally adjusted total labour market slack in the EU, consisting of unmet demand for labour, amounted to 29.6 million persons, which represented 14.0% of the extended labour force in the second quarter 2020, up from 12.8% in the first quarter 2020. This has been the highest quarter-on-quarter increase since the beginning of the time series in 2008.”

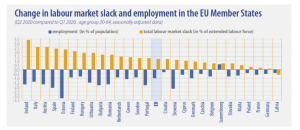

During the second quarter, in the member of states the overall labour market gap increased when compared to the first quarter, except in Latvia (-0.6 pp). the highest increases were reported in Ireland (+3.4 pp), Italy and Austria (both +2.6 pp), and Spain (+2.4 pp). Employment fell in all countries with the exception of Luxembourg (+0.6 pp). The highest drops in employment were recorded in Estonia (-3.3 pp), Slovenia (-2.2 pp) and Spain (-2.1 pp), and the lowest in Croatia (-0.3 pp), Latvia and Poland (both -0.4 pp).

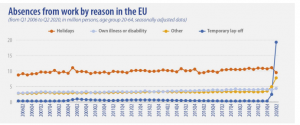

Number of employed persons temporarily absent from work up by over 80%

In 2020 second quarter, the number of person absent from work increased by 18.6 million when compared to 2020 first quarter, totaling to 40.9 million person. As reported by the Eurostat, this increase is almost most due to a surge in temporary lay-offs, which rose from 2.4 million persons in the first quarter to 19.3 million persons in the second quarter. Also, the number of persons absent from work due to reasons not including lay-off, holiday or illness, rose from 4.9 million to 7.8 million between the two quarters. The highest rate of absence observed among the member states were in Greece (39.6%), Cyprus (32.0%), Spain (27.9%) and France (27.7%) and the lowest rates in Bulgaria (10.9%), Latvia (12.0%) and Luxembourg (12.9%). Notably, all member states of which data was available experienced an increase in absences from work in the second quarter 2020.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.