May 9 2022

FosRich Company Limited (FOSRICH) for the three months ended March 31, 2022 booked a 64% increase in revenue to total $900.29 million compared to $549.28 million for the same quarter in 2021. The Company noted that, “These increases were attributed primarily to increased sales in eight (8) of our eleven (11) Product Groups as follows: Control Devices, Industrial, LED, Lighting World, PVC, Solar, Wires and Wiring Devices.”

Cost of sales for the year increased 48%, moving from $357.59 million in March 2021 to $528.96 million for the period under review. As such, gross profit amounted to $371.33 million, an increase of 94% when compared to $191.69 million recorded for the quarter ended March 31, 2021.

Other income, for the quarter totalled $19.96 million an increase of 32% year over year, when compared to the $15.12 million recorded for the previous year’s comparable quarter.

Administrative and other expenses rose by 43%, to total $195.16 million (2021: $136.64 million). “The changes was driven primarily by increased staff related costs for salary adjustments, increased sales commission due to improved sales performance and improvements in staff benefits; increased occupancy cost due to the commencement of obligations for our new Fulfilment Centre at 76 Molynes Road; increased electricity cost; increased legal and professional fees; and increased depreciation due to increases in the carrying values of property plant and equipment. There were reductions in motor vehicle expenses” as per Management.

Finance costs of $37.24 million were recorded for the period, a 17% increase when compared to $31.80 million for the corresponding period in 2021. FosRich noted, “This increase is being driven primarily by increases in bank financing.”

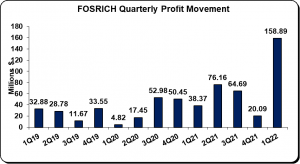

As a result, operating profit for the quarter rose by 314% to close at $158.89 million (2021: $38.37 million).

No taxes were incurred for the quarter, thus net profit for the three months ended March 31, 2022 totalled $158.89 million, a 314% increase compared to $38.37 million reported for first three months of 2021.

Earnings per share (EPS) for the period totalled $0.316 (2021: $0.076). The trailing twelve months earnings per share amounted to $0.637. The number of shares used in our calculations amounted to 502,275,555 units. FOSRICH’s stock price close the trading period on May 6, 2022 at $31.49 with a corresponding P/E of 49.45x.

Balance Sheet at a Glance:

As at March 31, 2022, total assets amounted to $4.28 billion, up 14% or $509.72 million in comparison to the $3.77 billion as at March 31, 2021. The increase in total assets was largely due to ‘Property, plant and equipment’ and ‘Accounts receivable’ which totalled $866.39 million (2021: $349.53 million) and $499.68 million (2021: $274.03 million), respectively. The company noted, “The Company continues to closely manage receivables with an emphasis being placed on balances over 180 days. We have implemented strategies to collect these funds as well as to ensure that the other buckets are managed. Seventy-two (72%) of receivables are within the current to 60 day category, up from the sixty-eight percent (68%) for the prior reporting period.”

Shareholders’ Equity of $1.67 billion was reported as at March 31, 2022 (2021: $1.02 billion) which resulted in a book value per share of $3.33 (2021: $2.02).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.