Brent Oil

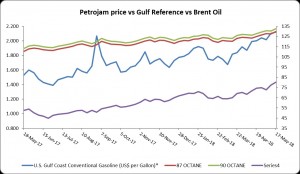

Brent oil prices decreased by 3.67 % or US$2.84, as prices fell this week. Oil traded on May 17, 2018 at a price of $80.31 per barrel relative to US$77.47 last week. Brent oil began the year at US$68.07 per barrel.

Petrojam prices

87 Octane prices increased week over week, by 1.80% (JMD$2.29). Additionally 90 Octane rose by 1.76% or (JMD$2.29) week over week. 87 Octane and 90 Octane opened the year at J$121.04 and J$123.88 respectively and now trades at J$129.83 and J$132.67 per litre respectively.

Figure 1: Petrojam, U.S. Gulf Coast Conventional Gasoline Regular and Brent Crude Oil 1 Year Price History

This Week in Petroleum

Total liquid fuels inventories return to five-year average levels in the United States and the OECD

The lengthy period of oversupply in global petroleum markets which commenced prior to the Organization of the Petroleum Exporting Countries (OPEC) ‘s agreement in November 2016 to halt production has now ended. The excess build-up of inventories within this time has now been cut down. As the OPEC plans to continue June 22, markets are more balanced however uncertainty persists.

“The November 2016 OPEC supply agreement took effect in January 2017, whereby OPEC member countries agreed to reduce crude oil production by 1.2 million barrels per day (b/d) compared with October 2016 levels and to limit total OPEC production to 32.5 million b/d. In addition, Russia agreed to reduce its crude oil production. OPEC extended the agreement in November 2017, with the production cuts remaining in place until the end of 2018.”

Beginning last year January one of the main factors of a stringent world oil market has been a reduction in crude oil and other liquid inventories. After rises in quarterly global liquid inventories from mid-2014 to majority of 2016, inventories started to go down throughout 2017 and into the first quarter of this year. Data for global petroleum inventories are not collected directly. Instead, variances in global inventories are implied based on the difference between world production and world consumption estimates. However, inventory data for the United States and for countries within the Organization for Economic Cooperation and Development (OECD) are available and assists in determining what is happening globally.

For additional information click the link below:

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.