January 19, 2021

iCreate Limited (ICREATE) for the nine months ended September 30, 2021 reported revenues of $31.83 million, 32% down from $47.12 million reported a year ago. For the third quarter, ICREATE posted $7.97 million in revenue (2020: $7.86 million). Management noted, “the education division of the company continues to be impacted by the fallout experienced from the Covid-19 pandemic.”

Total direct costs amounted to $5.26 million for the nine months period compared to $7.97 million for the nine months of 2020. Thus, resulting in gross profit of $26.57 million relative to $39.16 million booked last year. Gross profit for the quarter amounted to $6.94 million versus $6.66 million booked for the third quarter of 2020. Other income for the nine months amounted to $5.33 million relative to $68,256 booked in 2020, while the other loss for the quarter totalled $73,098 (2020: income of $34,106).

Total operating expenses for the period closed at $22.32 million in contrast to $38.86 million for the corresponding period of 2020. Operating expenses for the third quarter totalled $6.65 million (2020: $11.29 million). Of this, administrative expense decreased by 46% to $19.39 million (2020: $35.94 million) for the nine months. Depreciation and amortization expense had a marginal increase to close at $2.93 million, virtually unchanged compared to the corresponding period in 2020.

As such, operating profit for the period closed at $9.57 million in contrast to an income of $361,204 for the corresponding period of 2020. Operating income for the third quarter closed at $219,162, relative to a loss of $4.60 million booked in 2020.

Finance cost for the nine months amounted to $5.71 million relative to $2.62 million a year ago.

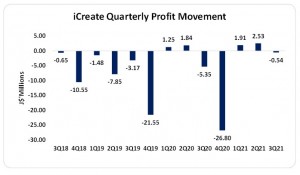

Consequently, net profit for the nine months period amounted to $3.87 million versus a loss of $2.26 million in 2020. For the third quarter, net loss totalled $536,551 compared to $5.35 million booked in the corresponding quarter last year.

For the nine months, ICREATE reported comprehensive income of $3.87 million, relative to a comprehensive income of $4.81 million booked in 2020. While for the quarter, total comprehensive loss amounted to $536,551 versus an income of $1.72 million booked for the corresponding period.

Earnings per share (EPS), for the nine months ended September 30, 2021, amounted to $0.02 compared to a LPS of $0.01 for the same period of 2020. The loss per share for the quarter amounted to $0.003 relative to $0.03 reported in 2020. The trailing twelve months LPS is $0.12. The number of shares used in this calculation was 197,592,500 shares. iCreate traded on January 18, 2022 at $0.88.

ICREATE noted, “Our decline in performance in revenues is based on our inability to conduct the physical and hands-on training that we used to. These account for 60% of revenues. The company continues to find new ways of earning and we are pleased that our video production division of the company was able to step up during the last quarter and delivered 27.9% of total revenues. This is newly launched and we expect to continue to see growth in the division going into 2022.”

Furthermore, “We are pleased to announce that the acquisition of Mobile Edge has been completed. This will see a joint venture being executed to form a new company, GetPaid Limited. The GetPAID Suite is a set of Jamaican made ecommerce payment solutions, built specifically to serve the diverse needs of businesses who want to sell online and service customers anywhere-anytime,” as per iCreate.

Balance Sheet at a Glance:

As at September 30, 2021, total assets decreased to close at $40.12 million (2020: $56.30 million). The decrease was largely due to a $8.90 million decline in ‘Fixed assets’ which closed at $10.84 million (2020: $18.07 million) and ‘Investment or Other Non-Current Assets’ which closed at $5.84 million (2020: $11.97 million).

Shareholder’s deficit totalled $23.12 million compared to a shareholders ‘deficit of $792,411 quoted as at September 30, 2020. This resulted in a shareholders’ deficit per share of $0.117 (2020: $0.004).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein