May 4, 2022

iCreate Limited (iCreate) the three months ended March 31, 2022 reported revenues of $46.39 million, 451% up from the $8.42 million reported a year prior.

Total direct cost for three months amounted to $21.11 million, 1221% more than 2021’s three months direct cost of $1.60 million.

Other income for the quarter amounted to $8,051 relative to $5.37 million for 2021. As such, total income for the three months amounted to $25.29 million compared to $12.19 million for the first three months of 2021.

Administrative expenses rose 91% to $13.40 million (2021: $7.02 million) for the three months, while Depreciation & amortization fell by 28% to close at $696,857 compared to $971,053 booked for the prior corresponding period. As such, total operating expenses for the quarter closed at $14.10 million, 77% more than the prior year same period’s operating expense of $7.99 million.

Operating profit for the quarter closed at $11.19 million in contrast to a profit of $4.20 million for the corresponding quarter of 2021.

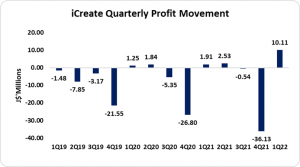

Finance cost for the first quarter amounted to $1.08 million relative to $2.29 million documented last year same time. Consequently, profit before taxation amounted to $10.11 million versus a profit of $1.91 million twelve months earlier.

No taxation was posted for the current period, thus resulting in net profit after taxation of $10.11 million relative to a profit of $1.91 million for the three months ended March 31, 2021.

Consequently, earnings per share (EPS) amounted to $0.05 compared to an EPS of $0.01 for the same quarter of 2021. The trailing twelve months LPS is $0.12. The number of shares used in this calculation was 197,592,500 shares. iCreate traded on May 3, 2022 at $3.24.

iCreate noted, “Revenue growth is attributable to the various initiatives announced by the company at its recent Annual General Meeting around the plan to deliver our 2-to-1 financial strategy which is to deliver US$2 million in revenues and US$ 1 million in profits. Our core business, the Institute/Education division to consumer to business to business with a focus on gaining more corporate clients and partnerships. The company currently now has three major long term corporate training partnerships.”

Additionally, iCreate noted, “We have cleared all our principal tax payments, up to date with our loan obligations and have significantly cleared off our at risk payables. The investments from both Kintyre Holdings Limited and Dequity have contributed to a strengthened Balance Sheet, in addition to enabling us to invest in the leadership team needed to take us to the level of desired growth and profitability.”

Balance Sheet at a Glance:

As at March 31, 2022, total assets decreased to close at $52.69 million (2021: $54.74 million). The decrease was largely due to decrease in ‘Property, Plant and Equipment’ and ‘Trade and Other Receivables’, which closed at $5.18 million (2021: $16.29 million) and $14.34 million (2021: $19.03 million) respectively.

Shareholder’s equity totaled $19.67 million compared to the $5.41 million deficit quoted as at March 31, 2021. This resulted in a shareholders’ equity per share of $0.10 relative to a shareholders’ deficit per share of $0.03 the prior year.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein