Date: July 25, 2019

Jamaican Teas Limited (JAMT), for the nine months ended June 30, 2019, reported a decline in revenues to total $1.01 billion (2018: $1.34 billion). For the quarter, revenues amounted to $316.67 million compared to $438.61 million in the previous corresponding quarter. JAMT stated that, “the quarter shows a sharp fall in revenues but this does not reflect a negative development for the Group as it arose from a decision to dispose of 100% of the supermarket previously owned by JRG Shoppers Delite to an associated company, Bay City Foods Ltd (BCF). We also acquired a debenture in BCF previously owned by a third party in exchange for shares in JTL.”

Cost of sales fell 32% to $730.17 million (2018: $1.08 billion), in which gross profit went up 5% to close at $278.96 million (2018: $264.57 million). Gross profit for the quarter closed at $87.34 million (2018: $88.29 million). Management indicated that, “the Groups’ gross profits were little changed in the quarter but improved by $14 million in the year to date due mainly to the non-recurrence of the losses reported at Orchid Estates in 2018.”

Other income increased vastly closing the period at $206.92 million versus $61.77 million in the prior corresponding period. Other income for the quarter closed at $141.93 million compared to $16.73 million documented in the same period last year. The increase in other income was due to a surge in ‘Interest income’ and ‘Fair value gain on investment’ which, year to date, closed at $10.60 million (2018: $1.98 million) and $126.29 million (2018: nil), respectively.

Administrative expenses rose by 8% to $140.93 million for the nine months ended June 2019 relative to $130.66 million for the same period of 2018. Sales and marketing costs went up by 5% totaling $40.07 million (2018: $38.26 million). For the quarter, administrative expenses and sales and marketing costs closed at $52.97 million (2018: $42.63 million) and $11.63 million (2018: $18.41 million), respectively. It was noted that, “The $10 million increase in administrative expenses for the quarter and the year to date, primarily reflects accrued operating expenses at QWI.”

Finance cost for the period under review amounted to $15.83 million (2018: $14.26 million), while for the quarter finance costs closed at $7.13 million versus $4.83 million in the prior corresponding quarter.

Pre-tax profits climbed to $289.42 million in 2019 from $143.15 million booked in the previous year. While, for the quarter, pre-tax profits closed at $157.60 million (2018: $39.16 million). Loss from discontinued operations for the nine months ended June 30, 2018 amounted to $1.26 million relative to nil for the same period in 2019.

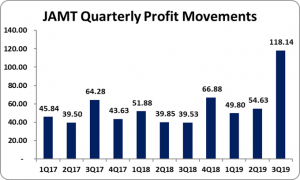

Taxation for the period closed at $21.67 million (2018: $10.57 million). Net profit for the period surged to $267.75 million in the period under review relative to $132.58 million recorded twelve months earlier. For the quarter, net profit closed at $151.63 million (2018: $40.11 million). Net profits attributable to shareholders amounted to $220.13 million (2018: $131.67 million).

Consequently, earnings per share totaled $0.32 compared to $0.19 for the period ended June 2018. For the quarter, EPS closed at $0.17 (2018: $0.06). The trailing earnings per share amounted to $0.42. The numbers of shares used in the calculations are 686,033,460 units. JAMT last traded on July 24, 2019 at $4.29.

JAMT highlighted that, “as reported previously QWI, a company controlled 100 percent by Jamaican Teas and KIW International, was set up to focus primarily on quoted investments. All the Group’s quoted investments were transferred to it at the start of the quarter. The benefits of pooling the group’s quoted investments in one company are well demonstrated by the good investment results for this quarter which included realised investment gains of $43m (vs $11m in the year ago quarter) and fair value gains of $100m (vs unrealized gains of $9m in the year ago quarter). By the end of the quarter, we had net investments of $579 million.”

In addition, “apart from our regular business, construction of an apartment complex in the Manor Park area continued to progress with completion presently scheduled for November 2019.We are currently receiving offers from interested purchasers,” JAMT noted.

Balance Sheet at a glance:

As at June 2019, the Company total assets amounted to $1.37 billion, a decrease of 18% when compared to the $1.67 billion reported as at June 2018. This decrease was driven primarily by a downward trajectory in ‘Inventories’ and ‘Cash and Cash Equivalents’ closing the period under review at $204.12 million (2018: $280.72 million) and $140.13 million (2018: $172.60 million), respectively. However, the decline was partially tempered by an upward movement in ‘Associated Company’ closing at $72.83 million (2018: $29.63 million).

Shareholders’ Equity totalled $1.45 billion as at June 2019 (2018: $1.15 billion), resulting in a book value per share of $2.10 (2018: $1.67).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.