November 16, 2020

JETCON for the nine months ended September 30, 2020 reported total turnover of $467.16 million, 38% less than the $747.99 million reported for the corresponding period in 2019. Turnover for the third quarter fell 45% to $153.43 million compared to $280.82 million in 2019. Management noted, “Jetcon Corporation is among companies that experienced negative effect, with the company’s second quarter being the worse one for us. Following a loss in the June quarter, with sales falling sharply, business picked in the September quarter, but sales continue to be lower than in 2019. This trend is expected to continue into the fourth quarter.”

Cost of Sales for the period decreased 37% to $391.01 million (2019: $622.28 million), As such, Gross Profit for the period decreased by 39% to $76.16 million compared to $125.70 million in 2019. Gross profit for the quarter amounted to $25.42 million relative to $45.23 million booked for the same quarter of 2019.

Total Expenses for the period decreased by 12% to $70.60 million (2019: $80.18 million). Of this, Selling and Marketing Expenses for the period decreased to $15.22 million (2019: $16.86 million), while Administrative and Other Expenses recorded a decline of 16%, closing at $41.13 million (2019: $49.23 million). Finance costs closed the period at $3.16 million a 341% increase when compared to the $717,397 booked in the prior year. Other operating cost for the nine months period closed $11.09 million relative to $13.38 million booked for the corresponding period 2019.

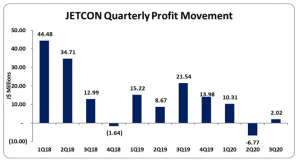

Consequently, Profit Before Taxation amounted to $5.56 million relative to $45.52 million in 2019, representing an 88% decrease year-on-year for the period. Profit before tax for the quarter fell 91% to $2.02 million (2019: $21.56 million).

There were no taxation charges for the period as such, net profit for the period amounted to $5.56 million relative to $45.52 million twelve months earlier. While, net profit for the quarter amounted to $2.02 million compared to a profit of $21.56 million for the same quarter in 2019.

As such, the earnings-per-share (EPS) for the period amounted to $0.01 relative to $0.08 last year. EPS for the quarter amounted to $0.003 in contrast to an earnings per share of $0.037. The trailing twelve months EPS is $0.03 where the number of shares used in our calculation is 583,500,000. JETCON’s last traded price as at November 16, 2019, was $0.85.

Management noted, “Despite the challenges so far due to the COVID-19 pandemic, Jetcon has managed to endure with a relatively strong financial position. With smart marketing and pricing strategies, business continues to recover. We will continue to actively adjust these strategies as time goes on

Balance Sheet Highlights:

The company, as at September 30, 2020 recorded total assets of $627.07 million, a decrease of 6% when compared to $664.20 million recorded last year. This decline was primarily attributable to the 15% in ‘Inventories’ to total $394.93 million (2019: $466.07 million). According to the Company, “Management undertook cost saving measures starting with the second quarter that resulted in reduced cost and kept a tight rein on the level of inventories, the companies biggest asset in monetary terms. We halted the purchase of inventories from March, which resulted in reduced inventories of vehicles since. We have begun purchasing vehicles again, to replenish certain models, as business slowly recovers. Nevertheless, inventories compared to the same third quarter of 2019 have decreased from $466 million to $395 million and the strategy for the next few months is for some more reduction in inventories.”

Total Stockholders’ Equity as at September 30, 2020, closed at $552.90 million, compared to $532.56 million for the corresponding period last year. This resulted in a book value per share of $0.95 per share compared to $0.91 as at September 30, 2019.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.