Date: May 13, 2019

Jamaica Producers Group Limited (JP), for the three months ended March 31, 2019, booked a 7% increase in revenue to total $4.79 billion compared to the $4.48 billion reported in 2018.

The Food and Drink Division reported a 4% increase in revenue to total $2.75 billion relative to $2.64 billion reported in 2018. The Group stated that, “during the quarter, the JP F&D Division benefitted from a solid result in the European juice business, improved yields on banana farms in Jamaica and growth in regional consumer and travel retail markets in which JP St Mary’s and Tortuga brands trade.”

Logistics and Infrastructure increased by 11% year over year to total $2.04 billion (2018: $1.83 billion). The Group highlighted that, “the Logistics & Infrastructure Division continues to benefit from a series of initiatives to develop Kingston Wharves as a leading regional multipurpose and multiuser terminal, and Newport West as a warehousing and logistics hub. During the first quarter, Kingston Wharves benefited from handling growing volumes of domestic and regional trade in a range of cargo types including bulk, breakbulk and automotive shipments.”

The Corporate Services division earned $22.26 million relative to $26.29 million in 2017, a 15% decline.

The cost of sales for the three months marginally decline to total $3.138 billion compared to $3.143 billion reported for the comparable period in 2018. As a result, gross profit increased to close at $1.65 billion, a 24% growth on the $1.34 billion documented in 2018.

JP’s selling, administration and other operating expenses rose 8% to close at $876.63 million, this compares to $815.26 million booked a year earlier. JP also recorded a share of profit in joint venture and associated company of $453,000 relative to loss of $421,000 reported in the previous corresponding period. Other losses for the quarter amounted to $27.83 million in contrast to an income of $53.05 million reported for the same quarter of 2018.

Finance cost was reported at $79.02 million for the period relative to the $98.26 million reported in 2018. This resulted in profit before taxation of $667.77 million for the period (2018: $475.11 million).

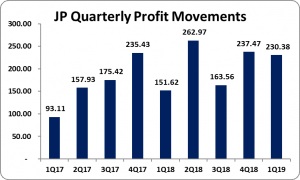

The Group incurred tax charges of $156.61 million (2018: $112.21 million). Consequently, net profit for the period rose by 41% to close at $511.15 million (2018: $362.91 million). Notably, net profit attributable to shareholders totalled $230.38 million; this compares to $151.62 million reported in the prior corresponding period.

Earnings per share for the period amounted to $0.21 (2018: $0.14) while the twelve-month trailing earnings per share amounted to $0.80. The number of shares utilized in the computations amounted to 1,122,144,036 units. JP stock last traded on May 10, 2019 at $24.30.

JP mentioned that, “Subsequent to the end of the first quarter, JP announced the sale of 30 percent of its snack food operations (including the JP St. Mary’s brand) to Wisynco Group Limited (‘WGL’) for approximately $740 million. The deal has been completed with effect from April 29th and as part of the deal, WGL was appointed the exclusive distributor for JP St. Mary’s snacks in Jamaica. JP looks forward to partnering with Wisynco to continue to grow the JP St. Mary’s brand in Jamaica and internationally and we are very optimistic about the prospects for this business. We expect sales growth to arise from more streamlined distribution and, importantly, from ongoing new product development in tropical snacks.”

Additionally, the Group noted that, “during the quarter JP completed the installation of a new large scale, high pressure processing line for the juice plant, and new bagging lines and power systems for the snack factory. The Tortuga bakery also completed the product development work and launch programme for two new cake lines for Spanish language markets, and for a banana bread for the Jamaican market, made with JP St. Mary’s bananas from our farm.”

Balance Sheet Highlights:

As at March 31, 2019, the Group’s asset base totalled $36.40 billion, 12% more than its value of $32.42 billion a year ago. This increase was due largely to increases in ‘Right-of-use assets’ and ‘Securities purchased under resale agreements’ which closed at $1.56 billion (2018: nil) and $4.30 billion (2018: $3.24 billion), respectively.

The Group ended the period with equity attributable to shareholders in the amount of $12.28 billion relative to $11.47 billion in 2018. The company now has a book value per share of $11.54 versus $10.22 in 2018.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.