Date: July 23, 2019

Jamaica Stock Exchange Limited (JSE), for the first six months ended June 30, 2019 recorded total revenue of $874.52 million, a 31% increase when compared to the $665.92 million booked the prior year’s corresponding period. For the second quarter the company reported a 36% increase in total revenue to close the quarter at $429.41 million (2018: $316.34 million). The company noted, “this can be attributed mainly to excellent performances in Cess Fee which increased by $47.4 million (47%) and Fee Income which increased by $53.20 (27%) when compared to 2018 Second Quarter. Worthy of note is the improvement in eCampus Income which increased by $9.20 million (256%) when compared to the corresponding quarter for 2018. This is due mainly to an increase in the number of seminars and workshops.” JSE ‘s revenue breakdown for the six months period are as followed:

- Cess income increased 27% to $287.70 million relative to $227.33 million the previous year.

- Fee income grew $113.40 million to close the period at $501.59 million (2018: $388.20 million).

- E-campus showed an increase of 396% to $33.83 million, relative to $6.81 million in 2018.

- Other operating income rose 18% during the period to total $51.40 million compared to $43.58 million in 2018.

Total expenses for the six months increased up by $125.52 million or 32% moving from $398.02 million in 2018 to $523.54 million. Of this:

- Staff Costs had a 24% increase for the period totaling $211.99 million (2018: $171.29 million). Staff Costs for the quarter increased by $19.55 million or 23% which was, “due to increases in salaries in 2019 and cost associated with new staff hires required to support the expansion of current business.”

- Depreciation and amortization totaled $26.34 million relative to $25.44 million in 2018. For the second quarter depreciation and amortization went up by $171,000 (1%).

- Professional fees amounted to $30.32 million, a 10% decrease year over year, but for the quarter, JSE registered a decreased of 15% to close at $13.96 million.

- Property expenses climbed $14.65 million to $82.03 million during the period under review. In addition, property expenses in Q2 exceeded 2018 by $7.42 million (21%) which was, “attributed to increase in maintenance costs and licence expense.”

- Other operating expenses increased by 28% to $33.08 million from $25.87 million the previous year.

- Advertising and promotion increased from the $30.51 million booked for the first six months of 2018 to $63.09 million for the corresponding period in 2019. For the quarter, Advertising and promotion increased 192% to 25.93 million (2018: $8.89 million) which was due to, “planned increase in advertising, public relation and outreach activities being carried out by the Group, in respect of the 50th Anniversary promotions.”

- Securities commission fees posted an 33% increase year over year to close at $44.26 million (2018: $33.22 million).

Investment income moved from $16.65 million posted for the first six months of 2018 to $13.66 million, reflecting an 18% decrease year over year.

Consequently, profit before tax totaled $364.65 million compared to $284.52 million the year prior. For the second quarter the company reported a 34% increase in profit before taxation totaling $179.49 million compared to $133.52 million recorded for the prior year’s similar quarter. Tax charges for the six months rose to $119.28 million relative to $93.45 million the prior year.

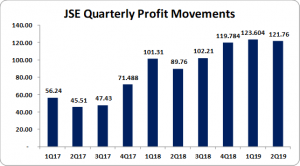

As such, JSE reported a net profit of $245.37 million for the six months compared to a profit of $191.07 million for the prior year, an 28% advance. Net Profit for the quarter had a 36% increase to total $121.76 million compared to $89.76 million the year prior. JSE highlighted, “this represents an improvement of $32 million (36%) when compared to the profit of $89.80 million for the corresponding period in 2018. Improvement in net profit continues to be positively impacted by increased market activities and impact of JSEG diversification strategies.”

Earnings per share for the six months totaled $0.35 compared to $0.27 in 2018. EPS for the quarter amounted to $0.17 (2018: $0.13). The trailing twelve months earnings per share amounted to $0.67. The numbers of shares used in the calculations are 701,250,000 units. JSE stock price last traded on July 22, 2019 at $37.44. JSE, “The second quarter performance has been excellent and the outlook for the remainder of the year is positive especially as it is expected there will be more listing of companies listing their securities on the Exchange and other new product offerings. It is also anticipated that there will be a positive movement in Fee Income due to expected increase in the Group’s clientele and increased in the number of investors.”

Balance Sheet at a glance:-

As at June 30, 2019, assets totaled $1.58 billion, a 19% increase when compared with its balance of $1.33 billion a year prior. The increase was due to a 23% increase in ‘Property, Plant and Equipment’ from $491.78 million to $503.20 million and ‘Trade and Other Receivables’ which also contributed to the increase amounting to $297.52 million (2018:$185.75 million)

Shareholders’ Equity amounted to $1.20 billion (2018: $1.03 billion), resulting in a book value per share of $1.71 (2018: $1.47).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.