Date: November 18, 2019

Key Insurance Company Limited (KEY) for the nine months ended September 30, 2019 reported a 79% decline in net premiums written to $199.62 million relative to $943.53 million recorded for the same period in 2018. This performance was as a result of a 22% decrease in gross premium written which closed the period at $1.14 billion (2018: $1.46 billion). Notably, insurance ceded for the period rose 80% to $935.80 million relative to $520.97 million for the period ended September 30, 2018. For the quarter, gross premium written went down 36% closing at $332.94 million (2018: $518.06 million). KEY indicated that, “our underwriting strategy to achieve our targeted risk profile business, resulted in reduced gross premium income of 36% over last year’s third quarter results. Additionally, the gross premiums written are a realisation of the correction of the aggressive motor business growth at KEY in line with the industry 24% year over year (YOY) growth over the last five years where we positioned ourselves to allow more customers to experience the KEY brand.”

Net premiums earned decreased by 74% to $224.32 million from $851.67 million in 2018. Additionally, net change in unearned premium reserve closed the period at a surplus of $24.71 million compared to a deficit of $91.87 million in 2018. While for the third quarter, net change in unearned premium reserve rose to a surplus of $12.89 million relative to a deficit of $22.36 million reported in the prior comparable year.

There was an underwriting loss of $341.28 million as at September 30, 2019 relative to a loss of $142.53 million. Claims expenses increased by 30% to $1.02 billion compared $783.27 million reported for the same period last year. For the quarter, claims expenses closed at $280.34 million (2018: $259.66 million). The Company highlighted that, “this improved performance has been further buttressed by, as previously reported the purchase of additional motor reinsurance.”

Administrative and other expenses totalled $312.29 million for the nine months, an 8% rise when compared to $289.34 million reported the prior year’s corresponding period. Likewise, for the third quarter, administrative and other expenses rose by 8% to close at $108.13 million (2018: $100.48 million). Reinsurance recoveries closed at $796.34 million compared to $105.25 million for the same period of 2018. Commission on premium written fell 23% to $107.02 million versus $138.54 million incurred for the nine months ended September 2018.

Investment income totalled $26.23 million, a 32% decrease relative to $38.85 million recorded for last year’s corresponding period, while other income fell to $16.24 million from $30.78 million in 2018. For the third quarter, investment income was $3.72 million (2018: $14.17 million), while other losses closed at $7.41 million versus an income of $10.97 million booked in 2018.

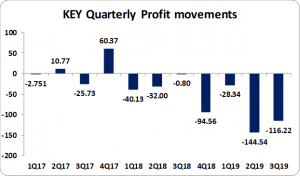

Loss before taxation drastically increased to $298.81 million for the period ended September 30, 2019 compared to a loss of $72.90 million in 2018. There was no taxation for the period versus a tax charge of $30,000 in 2018. Consequently, net loss for the period totalled $298.81 million relative to $72.93 million for the period ended September 30, 2018. Net loss for the quarter closed at $116.22 million versus a loss of $798,000 in the prior comparative quarter.

Loss per share (LPS) for the nine months totalled $0.81 relative to a loss per share of $0.20 in 2018, while LPS for the quarter totalled $0.32 compared to a LPS of $0.002 in 2018. The trailing twelve months loss per share is $1.07. The number of shares used in the calculation was 368,460,691 units. KEY stock last traded on November 15, 2019 at $3.30.

The Company noted, “additionally, the company’s MCT as at the end of the nine-month period is 253% above the FSC minimum regulatory requirement of 250% and a 123% improvement to that reported at December 2018. The company’s liquidity and investment position remain robust in conjunction with our continued efficiency in handling the claims of our valued policyholders.” Furthermore, “improved underwriting and reinsurance strategies in conjunction with cost containment and income earned from our investment portfolio which stands at $1.2 billion as at September 30, 2019 continue to be our focus to reverse the company’s loss-making position.”

Balance Sheet Highlights:

The company’s total assets amounted to $3.17 billion as at September 30, 2019 up from $2.85 billion as at the corresponding period in 2018, indicating an 11% increase year over year. This was mainly as a result of a 52% increase in ‘cash and deposits’ to $847.49 million (2018: $558.78 million) and a 202% growth in ‘due from reinsurers’ to $934.54 million (2018: $309.72 million).

Total Shareholders’ Equity as at September 30, 2019 closed the period at $584.06 million (2018: $1.05 billion), thus resulting in a book value of $1.59 (2018: $2.84).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.