For the period ended March 31, 2017, Kingston Wharves Limited (KW) reported revenues of $1.39 billion a 16% increase when compared to $1.20 billion for the same period last year. This as both the company’s ‘Terminal Operations’ and ‘Logistics & Ancillary Service’ segments reported increases.

The ‘Terminal Operations’ which accounted for 78% of total revenues, increased 14% year over year to a total of $1.08 billion relative to $940.09 million last year. According to KW, “Divisional profits increased by 21% from $274 million to $331 million. The main driver behind this growth was the container handling operations which advanced by 8% over the corresponding period of the prior year.”

The company’s ‘Logistics & Ancillary Services’ grew 21%, to total $310.51 million, up from $257.22 million. The company outlined that, “This was achieved primarily through an expanding customer base as a result of deliberate marketing and business development efforts as well as the deployment of new technology to improve our integrated logistics services and allow for improved security and more efficient systems for the warehousing, delivery and timely receipt of cargo.”

Cost of sales rose 13% to a total of $724.01 million (2016: $639.99 million). Nevertheless, gross profit grew by 19% for the period to total $662.04 million relative to $557.33 million recorded a year ago.

Other Operating Income fell 47% year over year, to total $23.18 million (2016: $43.48 million); Administrative Expenses increased by 7%, amounting to $252.31 million relative to $236.17 million for the same period last year.

As such, Operating Profit closed the period at $432.91 million, 19% more than last year’s total of $364.64 million.

Finance Costs for the year declined 23%, to close at $30.68 million for the period relative to $39.73 million booked for the corresponding period last year.

Profit before taxation rose 24% to $402.23 million for the quarter in contrast to the $324.90 million in 2016.

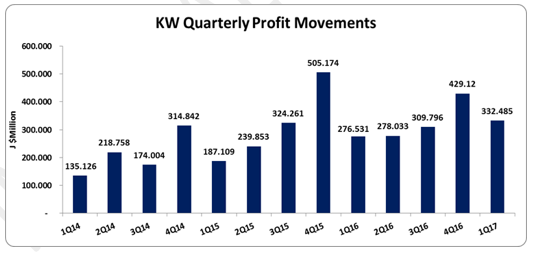

Income tax expense for the period increased 45% to $65.22 million compared to $45.12 million for the corresponding quarter in 2016. Consequently, net profits attributable to shareholders rose by approximately 20% to total $332.49 million relative to $276.53 million in 2016.

Earnings per share for the quarter ended March 31, 2017 amounted to $0.23 (2016: $19), while the trailing earnings per share EPS totaled $0.94. The total number of shares used in the calculations amounted to 1,430,199,578 units.

KW indicated, “In the face of a dynamic and competitive landscape, Kingston Wharves continues to strengthen its core services, while diversifying the range of cargo types that we are able to serve.” “We have invested considerably in our physical and technological infrastructure, embarking on significant terminal rehabilitation as well as the construction of a near-port domestic automotive centre to the benefit of both our terminal operations and our integrated logistics efforts. Our Total Logistics Facility, a purpose-built, state-of-the-art logistics complex will open our doors later this year, creating further opportunity to improve on our product offering and to execute planned vertical integration.”

Balance Sheet Highlights:

As at March 31, 2017, the company’s assets totaled $23.54 billion relative to $23.38billion a year ago, an increase of 7%, which was driven mainly by an increase in ‘Property, Plant and Equipment’ to total $18.27 billion from $16.58 billion.

Shareholders’ Equity amounted to $18.87 billion compared to equity of $17.73 billion reported as at March 31, 2016. The Company now has a book value per share of $13.20 (2016: $12.40).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.