For the three months ended March 30, 2017, Jamaica Stock Exchange (JSE) recorded total revenue of $241.07 million, a 26% decrease when compared to the $326.82 million booked the prior year’s corresponding period. JSE attributed the movement to, “an extraordinarily large transaction that occurred in Q1 2016.” Of this:

o Cess income declined 63% to $68.56 million relative to $183.38 million the previous year.

o Fee income grew $21.14 million to close the period at $134.48 million (2016: $113.35 million).

o E-campus showed a decrease of 27% to $2.68 million, relative to $3.68 million in 2016.

o Other operating income rose 2% during the period to total $51.51 million compared to $50.63 million in 2015.

Total expenses for the period inched up by $11.65 million or 8% moving from $150.30 million in 2016 to $161.95 million. Of this:

o Staff cost increased 32% to total $75.11 million for the period (2016: $56.87 million). The increase was, “due to salaries adjustments and increased staff complement to support new business lines.”

o Depreciation and amortization totaled $6.20 million relative to $5.03 million in 2016.

o Professional fees amounted to $10.63 million, a 14% increase year over year.

o Property expenses climbed $8.42 million to $28.24 million during the quarter under review which was “largely associated with increases in maintenance costs and other licenses exprense that were required based on the upgrades done on the Group’s IT infrastructure.”

o Other operating expenses fell 20% to $8.46 million from $10.60 million the previous year.

o Advertising and promotion declined marginally from the $20.71 million booked for the first quarter of 2016 to $20.57 million.

Investment income moved from $10.25 million posted for the first quarter of 2016 to $5.44 million, reflecting a 47% reduction year over year.

Consequently, profit before tax totaled $84.56 million compared to $186.77 million the year prior. Tax charges for the period decreased to $28.32 million relative to $61.28 million the prior year.

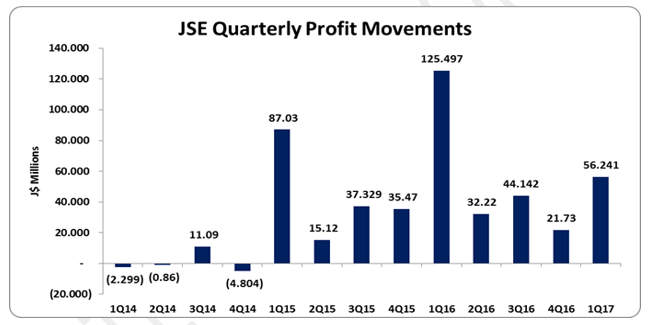

As such, JSE reported a net profit of $56.24 million compared to a profit of $125.50 million for the prior year, a 55% decrease. Earnings per share for the quarter totaled $0.08 compared to $0.18 in 2016, while the trailing earnings per share amounted to$0.22. The numbers of shares used in the calculations are 701,250,000 units.

JSE, “It is expected that for the remaining quarters there will be more companies listing their securities on the Exchange and a positive movement in Fee Income due to the expected increase in the Trustee Services clientele.”

Balance Sheet at a glance:-

As at March 31, 2017, JSE total assets valued $1.42 billion, 15% increase when compared with its balance of $990.70 million a year prior. The JSE highlighted that the increase was “due primarily to an increase in Property, Plant and Equipment, Intangible Assets, Trade and Other Receivables, Cash and Cash Equivalents and Post-Employment Benefits.”

Shareholders’ Equity amounted to $867.61 million (2016: $750.75 million), resulting in a book value per share of $1.24 (2016: $1.07).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.