June 15, 2021

K.L.E. Group Limited (KLE), for the first three months ended March 31, 2021 reported Total Revenue of $35.16 million, a 52% decrease when compared with the $72.67 million reported for the corresponding period of 2020. The Company mentioned that the decline in revenue, “shows a positive signal in the right direction for the business under the stringent curfew hours imposed. There is a significant reduction when compared with the previous year, the reason for this is related to the fact that the first two months of the prior year the restaurant operated at full capacity without the effects of the Covid 19 Pandemic.”

Furthermore, “The Kingston location recorded revenues of $23.9 million compared to the Montego Bay Location of $11.3 million. Management is confident that both location will perform better in the second quarter of the financial year,” as per KLE.

Cost of sales of $10.84 million was recorded year to date relative to $22.10 million for first three months of 2020. Management highlighted, “KLE will continue to employ cost savings strategies and monitor our Key Performance Indicators to improve efficiencies and achieve profitability.” Furthermore, the Company stated that the decrease in Cost of Sales occurred, “as a result of the first two months of 2021 operating at maximum capacity. The companies cost of operating is in line with the latest cost strategies and budgets.”

Gross Profit totalled $24.32 million, down 52% relative to the $50.57 million reported in the prior comparable period of 2020.

Other Operating Income for the quarter totalled $16,000 (2020: $3.60 million). Also, administrative and other expenses declined by 54% from $66.99 million in 2020 to $30.98 million for the period under review, this is due to, “the decrease is directly related to the reduction in business due to the Covid 19 Pandemic. Majority of our current admin expenses relates to expenses such as utilities ($5.4 million), salaries and wages ($14.3 million) Professional fees ($1.3 million),” stated by Management.

As such, there was a loss from operations which totalled $6.65 million relative to a loss of $12.81 million booked for the corresponding period of 2020. Finance and depreciation costs rose by $9.08 million, moving from $6.26 million last year to $15.34 million for the first quarter of 2021. KLE noted, “During the first quarter the company had to battle will several prices increase from several of our key suppliers. Some suppliers had multiple increases during the quarter. Also during the quarter, the rate of exchange had a significant impact on our cost strategies and on our vendor prices.”

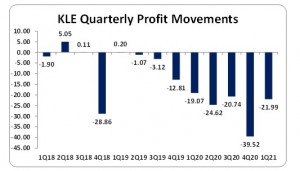

Consequently, loss before tax for the quarter amounted to $21.99 million relative to a loss before tax of $19.07 million in 2020. There was no taxation for the period (2020: nil), therefore, KLE reported net loss of $21.99 million relative to a net loss of $19.07 million reported in 2020.

Total comprehensive loss amounted to $22.10 million compared to $20.13 million reported for the first quarter of 2020.

Loss per share (LPS) for the three-month ended March 31, 2021 amounted to $0.22, while for the corresponding quarter of 2020, an earnings per share of $0.19 was recorded. The twelve-month trailing LPS is $1.07. The number of shares used in our calculations is 100,000,000. KLE’s stock price closed on June 14, 2021 at $1.24.

KLE stated that, “The year started out quite well despite the challenges as sales saw a bit of increase from the Christmas period into late January and early February. This however eventually tapered off as the government restrictions continued and got even more stringent.”

The Company highlighted that, “Management has made an attempt at planning using projections derived from emerging information related to the health and economic crisis we are facing. It would appear that with the expectation of a vaccine and declining cases that the industry may return to some level of normalcy within the near future and we are optimistic that our usual consistent flow of revenue will return.”

Balance Sheet at a Glance:-

As March 31, 2021, the Company reported total assets of $270.23 million (2020: $291.97 million). The main contributors to this decrease was ‘Related Parties’ and ‘Investment in Associate’ which amounted to $53.70 million (2020: $71.47 million) and $42.63 million (2020: $55.86 million), respectively. However, ‘Rights to use assets’ tempered this movement closing at $30.34 million (2020: nil).

Shareholder’s deficit closed the period at $27.25 million, relative to a Shareholder’s Equity of $79.21 million resulting in a shareholder’s deficit per share of $0.27, relative to a shareholder’s equity share of $0.79 booked last year.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.