March 09, 2020

K.L.E Group Limited (KLE), for the year ended December 31, 2019, recorded total revenue of $224.57 million (2018: $219.93 million), representing a 2% increase. Whereas revenue, for the fourth quarter ended December 31, 2019, rose 12% to $70.68 million (2018: $63.28 million). Notably, KLE mentioned that, “Revenue is directly related to sales from our flagship restaurant, Tracks and Records Marketplace and Management fees earned throughout the year.” Furthermore, “Sales from the restaurant performed better than expected as the major construction on Constant Spring Road continued into the 2019 year as well as the Marketplace location underwent a major renovation to the complex which made it difficult for customers to access the property. Management embarked on innovative marketing strategies to combat these issues resulting in the increase sales from the restaurant.”

Cost of sales for the year decreased by 2% to $64.25 million compared to the $65.67 million reported in 2018; as a result, Gross profit was up 4% to total $160.33 million relative to $154.26 million in 2018. While, Gross profit rose 8% to $52.71 million (2018: $48.83 million) for the quarter ended December 31, 2019. KLE stated that, “The decline in the cost of sales is related to the better supply prices based on price negotiation and contractual terms with vendors.”

Other operating income fell by 55% to $6.09 million relative to $13.57 million booked in the prior corresponding period. In addition, Administrative and Other Expenses decreased by 6% from $181.27 million in 2018 to $170.51 million for year ended December 31, 2019. This increase in expenses were partly attributable to: “increased marketing efforts in 2019 to combat the negative effects of the road work and the renovations of Marketplace and the change in the packaging of Materials used in compliance to the single use plastic and styrofoam ban,” as per Management.

Consequently, loss from operation amounted to $4.10 million in contrast to the loss of $13.44 million for the same period last year, representing a 70% improvement. Operating Loss for the quarter improved to $14.07 million (2019: loss of $29.29 million).

Finance and depreciation costs rose to $8.65 million when compared to $1.50 million for the same period of 2018, a 478% surge. Furthermore, Share of post-tax loss of equity accounted associate amounted to $4.75 million (2018: $12.69 million).

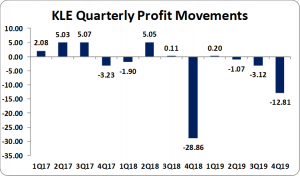

The Company reported tax credits in the sum of $682,000 relative to $1.91 million a year earlier. As such, KLE recorded a 35% reduction in net loss to $16.81 million compared to net loss of $25.71 million for the comparable period last year. For the fourth quarter ended December 31, 2019, net loss closed at $12.81 million (2018: loss of $28.86 million).

KLE highlighted that, “The company absorbed a $4.7 million loss from its associate company T&R Restaurant Systems Limited T/A Franchise Jamaica which was a significant contributor to it net loss position. The company has performed significantly better in 2019 than the previous year. Franchise Jamaica reported total revenues of $30 million for the 2019 year in comparison to 19 million in 2018.”

Total comprehensive loss for the year amounted to $14.84 million relative to a loss of $25.59 million in 2018.

Loss per share amounted to $0.17 for the year relative to a LPS of $0.26 in 2018. The number of shares used in our calculations is 100,000,000. The stock last traded on March 06, 2020 at $1.99.

KLE Group noted, “the company has successfully operated the Kingston location of Tracks and Records for the past 9 years. The infrastructure that exists to operate this business unit has been underutilized in the past. The domestic growth will aid in achieving these economies of scale. The franchising model will serve us better in major markets where we can capitalize on the infrastructure and market knowledge of major players already operating in these markets. This has proven very effective with our London franchisee. In order to achieve this and other key elements to our growth program, we are moving towards a significant capital raise which will enable the business to execute the plan. The last time the company had any injection of capital was in 2011.”

Moreover, “The international franchising will grow through partnerships with investors similar to the UK Franchisee. This investor profile requires a different level of support than the smaller single unit franchisee. On top of this we are zeroing in on two additional markets to move in while the UK market penetration continues. The focus will be on Toronto and South Florida. The focused approach has already resulted in some solid leads with investors we feel fit the bill.”

Balance Sheet Highlights:

The company, as at December 31, 2019, recorded total assets of $214.50 million, an increase of 8% when compared to $198.89 million in 2018. This increase was attributable to a 485% increase in “Investment in Associate” and a 35% increase in “Related Parties” to $12.92 million (2018: $2.21 million) and $63.39 million (2018: $46.87 million), respectively.

Total Stockholders’ Equity as at December 31, 2019 was $99.34 million, down from $114.18 million last year resulting in a book value of $0.99 (2018: $1.14).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.