Date: July 16, 2019

For the three months ended May 31, 2019, Caribbean Cream Limited (KREMI)’s turnover rose by 1% to $417.67 million (2018: $411.75 million). According to the Company, “sales were impacted due to a 2 weeks factory closure during this quarter to undertake modifications and repairs to enable us to gain HACCP Certification.”

Cost of sales also increased by 7% to $282.64 million (2018: $265.15 million) and according to management was attributable “to general local price increases”. Gross profit decreased by 8% to $135.02 million compared to $146.60 million in 2018.

Administrative Expenses climbed 21% to close at $91.72 million (2018: $75.90 million). According to management, “ this is primarily due to increased costs in utilities, rental and repairs and maintenance of the depots.” In addition, Selling and Distribution Costs rose by 13% from $13.22 million to $14.88 million. Consequently, operating profit for the quarter amounted to $29.02 million, down 50% relative to $58.04 million book in the prior year.

Finance costs for the first quarter was grew 79% to $6.06 million a vast increase when compared to the prior year’s first quarter of $3.38 million. Interest Income decreased by 14% to $610,758 from $711,475.

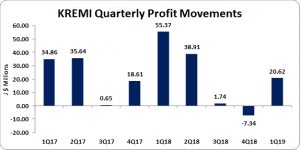

Consequently, profit before taxation amounted to $23.57 million relative to $55.37 million in 2018 representing a 57% decrease year-on-year for the period.

Taxes of $2.95 million were charged for the period relative to nil the prior year, as such net profit attributable to shareholders had a decline of 63% from $55.37 million in 2018 to $20.62 million.

As such, the earnings-per-share for the first three months of 2019 amounted to $0.05 relative to $0.15 for the same quarter last year. The trailing twelve months earnings per share totaled $0.14 (EPS:2018: $0.14 ). The number of shares used in our calculation is 378,568,115. KREMI’s last traded price as at July 15, 2019, was $5.44.

Management also noted, “In March of 2019, we “rolled out” our fully Novelty Line on “Five Fantastic Frosty Flavour of Icicles” Island wide which consisted of the following flavours: Watermelon, Grape, Kola Champagne, Sour Cherry & Green Apple. The launch was supported by the full range of media & promotional activities which included, TV, Radio, Press, Outdoor and social media campaigns together with “on the ground” sampling & promotional campaigns, a; featuring our lovable new Mascot “Mee”. “The new May Pen Depot opened its doors the 12th of April 2019, to serve May Pen and the surrounding communities. Both existing and new customers have given us very positive feedback noting the following in particular: Pricing, Product Availability, Ease of Access & Spacious Grounds.”

Balance Sheet Highlights:

The company, as at May 31, 2019, recorded total assets of $1.05 billion, an increase of 9% when compared to $964.59 million recorded last year. The increase in the asset base was due mainly to a $103.42 million increase in ‘Property, Plant and Equipment’ which closed at $708.79 million (2018: $605.37 million).

Total Stockholders’ Equity as at May 31, 2019, closed at $728.45 million (2018: $692.86 million) resulting in a book value per share of $1.92 per share (2018: $1.83 per share).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.