October 16, 2019

Caribbean Cream Ltd. (KREMI) for six months ended August 31, 2019 reported a 5% increase in revenue totalling $839.96 million compared to $799.51 million in the corresponding period last year. Revenue for the second quarter rose 9% to close at $422.30 million compared to $387.76 million for the comparable quarter of 2018.

Costs of Sales amounted to $571.45 (2018: $515.52 million), an increase of 11%. Management noted, “the company continues to experience price increases in its’ local purchases along with increased costs in utilities, specifically water due to the recent prolonged drought forcing the company to buy more trucked water than normal. The Company will continue to explore strategic initiatives to drive down costs.”

Nevertheless, Gross Profit fell 5% or $15.47 million to $268.52 million compared to $283.99 million for the period ended August 31, 2018. The company booked gross profit of $133.49 million for the second quarter versus $137.39 million reported for the similar quarter of 2018.

Administrative Expenses climbed 16% to close at $184.32 million (2018: $158.75 million), while Selling and Distribution Costs rose by 33% from $27.48 million to $36.50 million. Management indicated “our administrative expenses included a one-off cost in relation to the valuation of the company’s building. In addition, the company had additional costs associated with the opening of the new Depot in May Pen. The Company now controls four(4) depots for the distribution of its products where the expectation is to increase our sales reach and competitiveness.” Consequently, operating profit for the six months period amounted to $49.30 million, down 50% relative to $98.91 million book in 2018.

Finance Cost rose 59% year over year to amount to $9.73 million relative to $6.14 million recorded for the first six month of 2018. Interest income for the period, however, reflected a decline from $1.50 million to $804,324 for the six months.

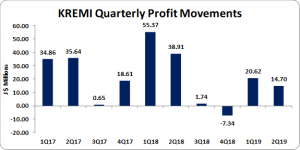

Taxation for the period amounted to $5.05 million compared whereas no taxes were charged for the corresponding period last year, as such Net Profit Attributable to Shareholders decreased by 63% from $94.28 million in 2018 to $35.32 million. Profit for the quarter amounted to $14.70 million (2018: $38.91 million), down 62% year over year. Consequently, Earnings per Share for the period amounted to $0.09 (2018: $0.25), while the EPS for the quarter totalled $0.04 (2018: $0.10). The trailing twelve months earnings per share amounted to $0.08. The number of shares used in these calculations were 378,568,115 units. Notably, KREMI’s stock price closed the trading period on October 15, 2019 at a price of $4.53.

Furthermore, the company noted, “ in April of this year, CCl commissioned its new novelty line to produce stick products and launched its new line of icicles. Initial sales have been encouraging. To support this product, we have kicked the advertising campaign into high gear, with visibility on TV, Radio, Billboards and Social Media. This combined with IN-store sampling continue to keep this new product in the forefront of consumers’ mind.”

Balance Sheet Highlights:

The company’s assets totalled $1.05 billion (2018: $981.11 million), $68.16 million more than its value as at August 2018. The increase in assets was largely due to an increase of $134.83 million in ‘Property, Plant and Equipment to a total of $749.16 million (2018: $614.33 million). Inventory also increased by 41% to close the year at $176.78 million compared to the $125.23 reported in the previous year. Cash and Cash Equivalents however tempered the increase over the past twelve months by a 69% decline to $58.05 million (2018: $188.57 million). Management noted, “the company continues to remain strong as total assets less current liabilities amounting to $874 million maintains its’ upward trend where it forges ahead with its investment in property, plant & equipment with the objective to improve operating efficiencies and diversify product offering.”

Shareholders’ equity was $743.15 million (2018: $731.77 million), representing a book value per share of $1.96 (2018: $1.93).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.