Main Event Entertainment Group Limited (MEEG) for the year ended October 31, 2017 recorded a total of $1.18 Billion in revenue compared to $1.13 Billion booked for the period ended October 31, 2017. Revenue for the quarter slid 16% to close the quarter at $233.65 million relative to $276.73 million booked for the corresponding period in 2016.

Cost of sales for the year decreased 13% year over year to $610.26 million relative to $703.87 million. Gross profit for the year improved 32% to $565.17 million (2016: $428.07 million). Gross profit for the quarter increase $16.72 million from $100.96 million reported for October 2016 to $117.68 million.

MEEG booked other income of $2.23 million for the financial year, 314% higher than the prior year’s $538,000.

Total expenses rose 26% to $443.77 million versus $353.56 million recorded for 2016. Of this, administrative and general expenses climbed 27% to $362.10 million (2016: $284.24 million), while depreciation expense increased 27% to $73.44 million (2016: $57.76 million). Selling and promotion expense slid 29% to $8.22 million relative to $11.56 million. Total expenses for the quarter amounted to $109.83 million, 13% higher relative to last year’s comparable quarter of $96.77 million.

Consequently, operating profit for the year rose 65% to $123.63 million (2016: $75.05 million).

Finance cost year over year, increased by approximately 2% to $15.45 million (2016: $15.20 million).

MEEG recorded profit before taxation of $108.18 million, a growth of 81% when compared to last year’s corresponding period of $59.85 million.

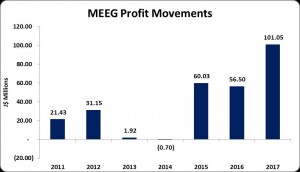

The company reported $7.14 million (2016: $3.35 million) for taxes during the year, resulting in net profit totalling $101.05 million compared to $56.50 million booked last year, a 79% increase year over year. MEEG reported net loss of $107,000 for the fourth quarter versus a net loss of $3.24 million for the comparable period in 2016.

Earnings per Share (EPS) for the year amounted to $0.34 (2016: $0.19), while for the quarter the company booked a loss per share of $0.0004 relative to a loss per share of $0.0108. The number of shares used in the calculation was 300,005,000 units. MEEG closed the trading period on January 02, 2018 at a price of $5.83 per share.

Balance Sheet Highlights:

As at October 31, 2017, the company’s assets totaled $718.91 million (2016: $565.12 million), , $155.81 million more than its value a year ago. This increase in total assets was largely driven by an increase in ‘Cash and Bank Balances’ which rose $72.40 million to close at $91.25 million relative to $18.84 million in 2016. ‘Property, Plant and Equipment’ also contributed to the overall improvement in the asset base year over year with a 15% growth to $421.08 million (2016: $365.90 million).

Equity attributable to stockholders of the company amounted to $446.33 million (2016: $242.23 million). This translated to a book value per share of $1.49 relative to $0.82 for the corresponding period in 2016.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.