June 14, 2021

Main Events Entertainment Group reported revenue of $349.38 million, 61% lower than the $884.81 million booked in 2020. Revenue for the quarter amounted to $173.54 million compared to $286.66 million recorded for the six months ended April 30, 2020. Management noted that, “Revenues earned from recurring services have made a marked, positive impact on our business activity. Of particular note, income from digital signage services represents over 14% of income for the current year to date. This compares to only 6% for the same period last year.”

Cost of Sales decreased 68% to close at $158.36 million (2020: $502.09 million). This resulted in gross profit decreasing by 50%, amounting to $191.02 million for the period relative to $382.72 million in 2020. Gross profit for the quarter closed at $80.30 million relative to $110.03 million for the comparable quarter of 2020. MEEG stated that, “The year-to-date gross margin of 55% remains considerably higher than the 43% reported in the prior year, with recurring services continuing to deliver strong margin contributions. At the same time, added concessions were taken to encourage our customers to undertake the limited activities permitted within our core business. Consequently, while revenues were relatively stable, the effects of the concessions are evident in the gross profit realized for this quarter.”

Other operating income for the period, fell by 91% to close at $33,000 (2020: $383,000). For the quarter, other operating income closed at $17,000 (2020: $77,000).

Total expenses amounted to $206.84 million (2020: $319.75 million) for the period, a 35% decrease when compared to the prior year. Of that, administrative and other expenses fell by 47%, moving from $248.05 million in 2020 to $132.36 million in 2021. Selling and promotions fell 79% to $1.71 million from $8.19 million reported in 2020. Depreciation amounted to total $62.42 million for the period (2020: $63.51 million). While amortization amounted to $10.35 million for the period under review. Management noted that, “the increase is associated with charges applicable under the new IFRS 16 (Leases) pronouncements. Additionally, employees’ base salaries were adjusted this quarter to relieve a portion of the temporary reductions made earlier in the pandemic.”

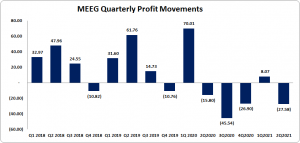

As such, operating loss amounted to $15.78 million in 2020 relative to an operating profit of $63.35 million for the period under review. MEEG’s recorded operating loss for the quarter closing at $25.16 million versus operating loss of $12.37 million booked in the previous comparable quarter. Finance costs for the six months decreased by 41% to close the period at $4.87 million (2020: $8.24 million).

Loss before taxation closed the period at $20.65 million relative to a profit before taxation of $55.11 million. MEEG recorded tax credit of $1.14 million for the period (2020: tax charges of $904,000), thus net loss amounted to $19.51 million versus a net profit of $54.21 million reported for the same period last year. Net loss for the quarter amounted to $27.58 million compared to net loss $15.80 million booked in the same quarter in 2020.

Consequently, loss per share (LPS) for the period amounted to $0.07 compared with an EPS of $0.18 reported for the corresponding period of last year. LPS for the quarter amounted to $0.09 (2020: LPS $0.05). The trailing twelve months loss per share amounted to $0.31. The numbers of shares used in the calculations are 300,005,000 units. Notably, MEEG stock price closed the trading period on June 11, 2021 at $5.13.

MEEG highlighted that, “With the continuing uncertainty as to the speed of recovery for the Entertainment industry, we will continue to take the steps necessary to boost the Company’s resilience in this environment. While business activity and sales volumes continue to be low, our ambitions are extremely high. We have been exploring new opportunities that we believe will bring us deeper global connections and greater business synergies, as our industry and world slowly recovers from the Pandemic.”

Balance Sheet at a glance:-

Assets totaled $813.33 million as at April 2021 relative to $940.36 million a year prior. The decrease in total assets was largely due to a decrease in ‘Property, plant and equipment’ which closed at $515.99 million (2020: $641.10 million).

Equity attributable to stockholders of parent amounted to $514.10 million (2020: $606.05 million) with book value per share amounting to $1.71 (2020: $2.02).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.