Date: December 2, 2019

NCB Financial Group Limited (NCBFG) for the year ended September 30, 2019 Net Interest Income increased by 27%, relative to 2018, to total $44.60 billion (2018: $35.14 billion). Management noted, “the growth in our Jamaican loan portfolio accounted for just under half of the increase despite lower interest rates; while the consolidation of five months of GHL’s results along with a full year of Clarien’s performance compared to nine months in the prior year accounted for the balance.”

Net Fees and Commission Income amounted to $19.18 billion, an increase of 21% on 2018’s $15.86 billion. NCBFG indicated, “the improved performance stems from the consolidation of GHL coupled with growth in transactions in our wealth and payment services (card acquiring and issuing) business segments.” Dividend income increased by 130% to a total of $1.27 billion (2018: $553.31 million). Other Operating Income increased 84% to $1.11 billion (2018: $605.45 million) while Credit impairment losses increased 146% to $4.82 billion in contrast to $1.96 billion recorded for 2018. Lastly, the Company’s Gain on foreign currency and investment activities declined 5% to $14.80 billion compared to $15.61 billion reported in 2018.

Consequently NCBFG’s Net results from Banking and Investment Activities climbed 16% to a total of $76.13 billion (2018: $65.82 billion). NCBFG noted, “our banking and investment services and insurance activities contributed equally to this increase which demonstrates the strength of our diversified business model.”

Net results from insurance activities for the year increased 280% to $14.43 billion (2018: $3.80 billion). According to NCBFG, “the growth was attributable to the consolidation of GHL’s insurance activities which contributed $7.1 billion to net insurance revenues, coupled with the improved performance of NCB Insurance Company Limited’s life insurance business which benefited from improved spread performance and reserve releases.” Of this, Insurance premium income rose 539% to $60.62 billion (2018: $9.49 billion), while reinsurance commission income advanced 3612% to $3.59 billion (2017:$96.83 million). Insurance premium ceded to insurers and policyholders and annuitants benefits and reserves amounted to $16.06 billion (2018: $823.44 million) and $35.68 billion (2018: $4.79 billion) respectively. Commission and other selling expenses surged to $6.42 billion compared to $230.06 million in 2018.

Total Operating Expenses for the year amounted to $64.74 billion, an increase of 49% compared to the $43.43 billion reported for the year ended September 30, 2018. According to NCBFG, “during the year, investments were made to innovate our service and product offerings, upgrade our technological capacity and core systems, advance our digital offerings and improve the skillsets and competencies of our employees. These investments will assist in strengthening the Group and position us to capitalize on growth opportunities. The consolidation of GHL was also a factor for the change in the metric.” Of these expenses:

-

- Staff costs increased 35% to $32.12 billion relative to $23.78 billion in 2018.

- Other operating expenses grew by 59% to $25.67 billion (2018: $16.18 billion).

- Depreciation and amortization grew 100% to $6.94 billion (2018: $3.47 billion).

Consequently, operating profit decreased 1% to total $25.83 billion (2018: $26.19 billion).

‘Share of profit of associate and gain on dilution’ amounted to $2.90 billion, up from 2018’s $2.57 billion. Gain on disposal of associate closed the year at $3.29 billion (2018: $837.48 million). The Company also reported a ‘Gain on revaluation of investment in associate’ and ‘Gain on disposal of subsidiary’ of $2.33 billion (2018: Nil) and $2.63 billion (2018: Nil) respectively. The Group also reported no negative goodwill on acquisition of subsidiary relative to$4.39 billion reported in 2018.

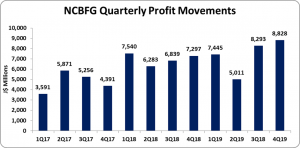

Consequently, profit before taxation increased 9% to $36.97 billion relative to $33.99 billion in 2018. Following taxation of $6.28 billion (2018: $5.41 billion), year-end net profit totalled $30.69 billion, an increase of 7% compared to $28.58 billion for the corresponding period of 2018. Without the goodwill booked in 2018, net profit would have increased by approximately 27%. Net profit for the quarter closed at $9.38 billion (2018: $7.63 billion).

Net profit attributable to shareholders closed at $29.58 billion for the year relative to $27.96 billion in 2018. Net profit attributable to shareholders for the quarter amounted to $8.83 billion (2018: $7.30 billion).

Earnings per share (EPS) for the year totalled $11.99 relative to $11.33 booked for the comparable period of 2018. The EPS for the fourth quarter amounted to $3.58 (2018: $2.96). The number of shares used in our calculations amounted to 2,466,762,828 units. NCBFG stock price closed the trading period at a price of $203.33 on November 29, 2019.

Management noted, “this has been a pivotal financial year marked by a significant milestone for the Group with the acquisition of a majority stake in Guardian Holdings Limited (GHL), a major financial services group providing life, health, property and casualty insurance, coupled with pensions and asset management services. This forms the foundation for a more customer centric integrated financial services group with the ability to provide broader range of services from a combined platform, while creating additional growth opportunities in the region.

Balance Sheet at a glance:

Total Assets increased to $1.61 trillion as at September 30, 2019 from $978.58 billion a year ago. This increase stemmed mainly from the growth in ‘Investment securities’, Loan and advances, net of credit impairment losses’ and ‘Pledged assets’. Investment securities and Loan and Advances, net of credit impairment losses closed at $386.16 billion (2018: $214.44 billion) and $423.10 billion (2018: $372.63 billion) respectively. Pledged assets increased from $176.91 billion in 2018 to $380.49 billion. ‘Due from banks’ also contributed to the increase in the asset base with a 190% growth to $141.36 billion (2018: $48.70 billion).

‘Equity attributable to shareholders of the parent’ as at September 30, 2019 stood at $147.30 billion relative to $130.04 billion a year ago. This resulted in book value per share of $59.71 (2018: $52.72).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.