February 14, 2020

Productive Business Solutions Limited (PBS) for the year ending December 31, 2019, reported an increase in revenues from US$179.29 million in 2018 to US$180.55 million in 2019, an 1% increase. For the quarter, revenues decreased 11% to total US$48.35 million relative to US$54.06 million the prior quarter.

Direct expenses decreased 5% to close the period at US$98.53 million when compared to US$104.23 million for the same period of 2018. As such, gross profit for the year increased 9% to US$82.02 million (2018: US$75.07 million). Gross profit for the quarter amounted to $23.94 million (2018: $21.94 million).

Other income declined 70% to close at US$419,000 relative to US$1.40 million in 2018.

Selling, general and administrative expenses amounted to US$70.05 million (2018: US$64.70 million), a 8% increase. As such, operating profit increased 5% for the period to total US$12.39 million relative to the US$11.76 million in 2018. Operating profit for the quarter totalled US$4.71 million, a 29% decrease on the US$6.60 million reported in 2018.

Finance costs decreased to total US$7.85 million relative to US$9.15 million in 2018. Management noted that this was, “primarily due to the refinancing of our bond”. As such, profit before taxation amounted to US$4.54 million, 74% increase on US$2.61 million reported in 2018.

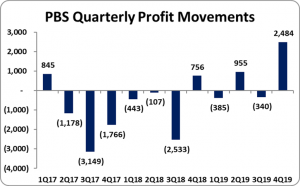

After taxation of US$2.18 million (2018: US$2.48 million) the company reported a net profit of US$2.36 million, an increase from US$134,000 in 2018. Net profit for the quarter amounted to US$2.28 million, a 54% increase on the US$1.48 million reported in the corresponding quarter of 2018. Total Comprehensive income for the period attributable to shareholders was US$2.49 million relative to the loss of US$2.32 million reported the prior year. Management noted, “Profitability increased significantly year over year driven by margin improvements as a result of increased sales of higher end service oriented products”.

For the period the company reported earnings per share (EPS) of US$0.02 (LPS 2018: US$0.02). The earnings per share for the quarter amounted to US$0.020 (EPS 2018: US$0.006). The total number of shares employed in our calculations amounted to 123,272,727 units. The stock price closed trading on February 13, 2020 at US$0.75.

Management noted that, “In 2020 we look forward to building on our base of high-quality recurring revenues by executing on several new projects across our printing, information technology, professional services, networking and advanced services business lines”.

Balance Sheet at a glance:

As at December 31, 2019, PBS had total assets totalling US$174.59 million (2018: US$167.04 million) which represents a marginal increase of 5%. This movement was mainly attributed to a 13% and 54% growth in ‘Property, Plant, and Equipment’ and ‘Current portion of lease receivables’ respectively to US$25.58 million (2018: US$22.66 million) and US$3.16 million (2018: US$2.05 million), respectively.

Shareholders Equity amounted to US$35.98 million (2018: US$35.08 million) with a book value per share of US$0.292 (2018: US$0.285)

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.