Date: March 29, 2019

This report combines estimates for January and February 2019, due to the recent partial government shutdown. February estimates are limited to personal income while January estimates include both personal income and outlays measures. Estimates of outlays for February will be available with the next release on April 29, 2019.

Personal Income and Outlays, January 2019

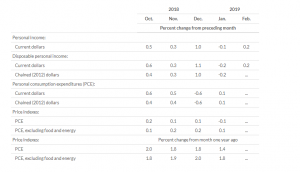

According to the Bureau of Economic Analysis “Real DPI decreased 0.2 percent in January, and real PCE increased 0.1 percent. The PCE price index decreased 0.1 percent. Personal income decreased $22.9 billion (-0.1 percent) in January according to estimates released today. Disposable personal income decreased $34.9 billion (-0.2 percent), and personal consumption expenditures increased $8.6 billion (0.1 percent). Excluding food and energy, the PCE price index increased 0.1 percent.” The BEA also noted the decrease in January personal income primarily reflected decreases in personal dividend income, farm proprietors’ income, and personal interest income that were partially offset by increases in social security benefit payments (related to cost of living adjustments) and other government social benefits to persons, which includes the Child Tax Credit and the Affordable Care Act refundable tax credit.

In January, real PCE rose $15.6 billion which revealed a $20.8 billion increase in spending for services that was partially offset by a decline of $7.7 billion in spending for goods. Within services, the largest contributor to the increase was spending for financial services and insurance. Within goods, new motor vehicles was the leading contributor to the decrease.

Personal outlays improved $6.3 billion in January, while personal saving was $1.19 trillion in January and the personal saving rate, personal saving as a percentage of disposable personal income, was 7.5 percent

Personal Income, February 2019

Personal income climbed $42.0 billion or 0.2 percent in February, while disposable personal income (DPI) rose $31.3 billion (0.2 percent); Real DPI is unavailable for February.

The increase in personal income in February primarily revealed increases in wages and salaries, government social benefits to persons, and proprietors’ income that were partially offset by the decline in personal interest income.

Chart Displaying personal income price change

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.