May 13, 2022

PanJam Investments Limited (PJAM) for the three months ended March 31, 2022, reported a total income of $774.98 million, 1% down from $784.85 million booked for the prior year’s corresponding period. Of total income:

-

- Other income increased slightly to $34.77 million relative to $34.72 million in 2021.

- Gain on investments amounted to $236.94 million compared to a gain on investments of $225 million for the three months ended March 31, 2021.

- Property income went down by 4% to $503.27 million (2021: $525.13 million).

PJAM noted, “income from PanJam’s core operations for the quarter remained relatively flat year over year. Our securities trading portfolio generated marginally improved investment income of $236.9 million, which was driven by higher dividends and unrealized trading gains. Although property income declined by 4.2 per cent, our real estate portfolio continued to show its resilience with stable occupancy of 92%.”

Operating expenses amounted to $551.13 million for the three months ended March 31, 2022 (2021: $422.37 million), 30% more than its total a year prior. PJAM mentioned that this, “increase of 30.5 per cent as a result of an increase in staff and professional services. Finance costs increased to $241.36 million (2021: $224.34 million) on higher average interest rates.”

Impairment recovery for the three months amounted to $2.45 million, 73% down from $8.93 million booked for the comparable period last year.

Consequently, operating profit closed the three months ended March 31, 2022 at $226.30 million relative to an operating income of $371.41 million recorded in the prior corresponding period.

Finance costs for the period rose by 8%, amounting to $241.36 million compared to the $224.34 million for the comparable period in 2021 due to “as a result of higher effective interest rates and increased borrowing levels,” according to PJAM.

Share of results of associated companies rose to close the quarter at $1.15 billion (2021: $902.65 million). Management highlighted that, “The results of associated companies consist principally of our 30.2% investment in Sagicor. We also hold minority positions in a number of diverse private entities across the adventure tourism, business process outsourcing, hospitality, consumer products, micro-lending and office rental sectors. Also, the 28% was driven by Sagicor results which grew by 31%.”

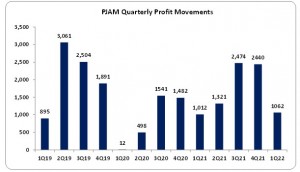

Profit before taxation closed the period at $1.14 billion, 9% increase from $1.05 billion booked in the same quarter last year. Following a taxation charge of $71.19 million relative to a taxation charge of $33.36 million, net profit amounted to $1.07 billion (2021: $1.02 billion).

Net profit attributable to shareholders for the period amounted to $1.06 billion, $51.76 million greater than the $1.01 billion recorded in the prior comparable period.

Total comprehensive loss closed the first quarter at $817.39 million versus total comprehensive income of $2.83 million in the same period last year.

Consequently, earnings per share for the period amounted to $0.996 (2021: $0.949). The twelve month trailing earnings per share is $6.80. The number of shares used in the calculation is 1,066,159,890 units. Notably, PJAM’s stock price closed the trading period on May 12, 2022 at a price of $66.47 with a corresponding P/E of 9.77 times.

Management noted, “while we believe that uncertainty will continue for some time, PanJam’s long-term investment horizon remains both relevant and appropriate to this environment, as evidenced by our flagship ROK Hotel and Residences project which is very close to completion.”

Balance Sheet at a glance:

As at March 31, 2022, PanJam Investments Limited (PJAM) had assets totalling $66.42 billion, a 6% increase relative to $62.44 billion a year prior. The growth was attributed to an increase in ‘Repayment and miscellaneous assets’ which amounted to $3.22 billion (2021: $681.43 million). ‘Property Plant & Equipment’ also contributed to the increase amounting to $3.96 billion (2021: $2.31 billion).

Shareholders Equity amounted to $50.46 billion (2021: $47.09 billion) with a book value per share of $47.33 (2021: $44.16).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.