Date: February 19, 2018

Pulse Investments Limited, for the six months ended December 31, 2017, reported revenue increased 15%, closing at $216.79 million, from $188.49 million in 2016, while for the quarter, revenue amounted to $97.41 million up by 21% compared to the $80.39 million booked in 2016.

Administrative and Other Expenses went up by 15% to $97.65 million (2016: $84.64 million) for the six months period. For the second quarter there was an increase of $11.29 million or 28%, closing the period at $51.38 million relative to 2016’s $40.09 million.

As such, Operating Profit increased 15%, closing the year at $119.14 million compared to the $103.86 million posted in 2016.

Profit before finance costs amounted to $178.41 million, an increase of 14% relative to the $156.64 million recorded last year.

Finance Cost for the six months decreased by 11% year over year, to close at $1.47 million (2016: $1.65 million).

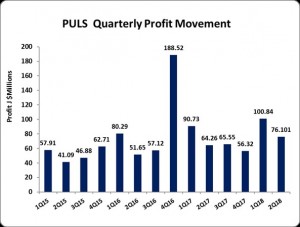

Net Profit attributable to members increased by 14%, closing the year at $176.94 million, from $154.99 million for the corresponding period in 2016, while for the quarter Net Profit totaled $76.10 million relative to $64.26 million reported in 2016.

Earnings per share (EPS) amounted to $0.11 for the six months relative to $0.10 in 2016. The EPS for the quarter totaled $0.04 versus $0.03 booked for the comparable quarter of 2016. The trailing twelve months earnings per share was $0.18. The number of shares used in the calculations is 1,630,738,044 units. PULS stock price closed the trading period in February 19, 2018 at $1.80.

Total Comprehensive Income for the first six months ended December 31, 2017 amounted to $181.89 million relative to the $159.93 million booked in 2016, a 14% increase year over year.

Balance Sheet Highlights

Assets totaled $2.66 billion, an increase of 17% relative to the $2.28 billion booked the year prior. This movement was driven by an increase in Investment Property totaling $1.57 billion (2016: $1.39 billion) and Advertising Entitlements Receivables amounting to $635.24 million (2016: $492.19 million).

Shareholder’s Equity as at December 31, 2017 stood at $2.47 billion (2016: $2.16 billion) resulting in book value per share of $1.51 (2016: $1.32).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.