July 14, 2021

QWI Investments Limited, for the nine months ended June 2021, reported gains from investment activities of $476.98 million relative to losses of $521.86 million booked the prior year. For the quarter, gain from investment activities of $217.70 million (2020: $100.44 million).

Unrealized currency translation closed the period at a loss of $388,333 relative to a gain of $8.26 million last year. Dividend income closed the period under review at $23.97 million (2020: $19.74 million). While, for the quarter, unrealized currency translation gain amounted to $11.10 million (2020: $24.13 million), whereas, dividend income closed at $6.43 million (2020: $4.32 million).

Administrative and other expenses amounted to $36.94 million (2020: $31.58 million), while interest expenses totaled $20.98 million (2020: $14.28 million). However, for the quarter ended June 2021, administrative expenses rose to close at $12.93 million (2020: $10.48 million). Interest expenses, for the quarter, increased to $7.93 million (2020: $2.48 million).

As such, profit before taxation for the nine months closed at $442.65 million relative to a loss before taxation of $539.71 million booked for the comparable period last year. For the quarter, QWI posted profit before taxation of $214.36 million (2020: $115.94 million). QWI noted that, “QWI’s Jamaican portfolio produced $336 million of unrealised gains in the year to date. Gains of $66 million were realised in the USA. The total investment gain for the year to date was $476 million, which represents almost a $1 billion turnaround from the $521 million of net losses in the year ago period.”

In addition, Management highlighted that, “The Company’s USA investment portfolio produced a total return in US$ of 31 percent, which represented a significant outperformance of the 20 percent growth in the S&P 500 and the 28 percent growth in the MSCI World Index.”

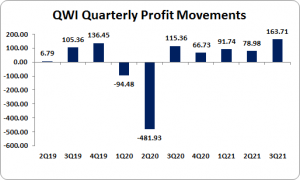

Year to date, QWI recorded a tax charge of $108.22 million compared to a taxation credit booked for the corresponding period last year for $78.66 million, thus resulting in profit for the period under review of $334.43 million relative to a loss of $461.05 million last year. Notably, for the quarter, QWI recorded profit for the period of $163.71 million (2020: $115.36 million).

Earnings per share for the period amounted to $0.25 for the nine months ended June 30, 2021 relative to LPS of $0.34 last year. The EPS for the third quarter was $0.12 (2020: $0.08). The trailing twelve months EPS is $0.29. The total shares outstanding used for this calculation was 1,365,000,015. Additionally, QWI closed the trading the period on July 13, 2021 at a price of $0.91 with a P/E of 3.10 times.

Balance Sheet at a Glance:

As at June 30, 2021, total assets closed at $2.28 billion (2020: $1.49 billion), a 52% increase. Of this increase, quoted investments (local) grew by 47% closing at $1.66 billion (2020: $1.13 billion). In addition, quoted investments (overseas) contributed to the increase amounting to $602.70 million (2020: $265.30 million). Management noted that, “At the end of the quarter, the Company held in excess of US$3 million in equities listed in the USA and Trinidad and Tobago. The portfolio includes positions in several leading information technology and life science companies, retailers, aerospace and service companies. Investments in local and overseas stocks amounted to $2.26 billion, with 73 percent of Jamaican listed stocks and the majority of the balance invested in the US market. The Company utilises borrowed funds in its investment activities which amounted to $407 million compared with $195 million in September 2020.”

Total shareholder’s equity as at June 30, 2021 amounted to $1.81 billion (2020: $1.41 billion). This resulted in a net asset value per share of $1.33 (2020: $1.03).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.