May 9, 2022

QWI Investments Limited (QWI), for the six months ended March 31, 2022, reported total income of $226.15 million relative to total income of $265.33 million booked in the corresponding period last year. Of this:

- QWI recorded gains from investment activities of $184 million for the period ended March 2022 relative to gains from investment activities of $259.28 million for the comparable period in 2021. While for the quarter, gain from investment activities amounted to $70.60 million versus gains of $126.85 million in the prior comparable quarter. “The Jamaican portfolio produced unrealized gains of $156.8 million versus $191.6 million a year ago. The 18 percent decline in investment gains were due to the lower price performance of some leading Jamaican stocks in the portfolio. The performance of the Company’s USA investment portfolio resulted in unrealized losses of near $10 million during the period. In addition to our investment gains which totalled $184 million, there was an unrealized exchange gain of $24 million compared to a loss of $12 million in the year ago period,” as per QWI.

- In addition, dividend and interest income amounted to $18.14 million as at March 2022 (2021: $17.54 million). However, for the quarter, this amounted to $5.54 million (2021: $7.18 million), down 23% year over year.

Unrealized currency gain amounted to 24.01 million compared to a loss of $11.49 million).

Administrative expenses for the period amounted to $56.89 million (2021: $23.68 million), while interest expenses amounted to $15.22 million (2021: $13.05 million).

As such, QWI ended the period with a profit before taxation of $154.04 million versus $228.61 million booked for the six months ended March 31, 2021.

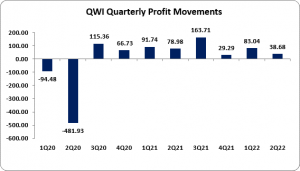

Consequently, following a tax expense of $32.32 million (2021 tax expense: $57.89 million), net profit for the period amounted to $121.72 million relative to a gain of $170.72 million booked for the six months ended March 31, 2021. The second quarter booked net profit of $38.68 million relative to a net profit of $78.98 million documented in the same period last quarter.

Earnings per share for the period amounted to $0.09 for the six months ended March 31, 2022 relative to earnings per share of $0.13 for the comparable period in 2021. While the EPS for the second quarter was $0.03 (2021 EPS: $0.06). The trailing EPS amounted to $0.23. The total shares outstanding used for this calculation was 1,365,000,015. Additionally, QWI closed the trading period May 09, 2022 at a price of $0.92.

Notably, Management stated that, “The Company’s portfolio is reviewed on an ongoing basis with changes as the Investment Committee believes will be advantageous to QWI. The sharp increases in inflation and interest rates now taking place could impact the prices of investments and securities negatively over the next two years. Indications are that our holdings will continue to perform well over the balance of the fiscal year and we remain cautiously optimistic. It is worth noting that in Jamaica we are still seeing a number of companies reporting good results and raising additional share capital. So far, investors are responding well to these developments and the current trend appears to be positive. While the Junior Market has led the improvement in the local market and more price gains are expected from that market, there are emerging signs that the JSE Main market could rebound sometime during this year.”

Balance Sheet at a Glance:

As at March 31, 2022, total assets closed at $2.41 billion (2021: $1.97 billion), a 22% increase. Of this increase, quoted investments (local) grew by 24% closing at $1.81 billion (2021: $1.45 billion). In addition, ‘due from brokers and receivables’ had an increase of $123.26 million to $128.73 million (2021: $5.47 million). The overall movement in the asset base was tempered by quoted investments (overseas) which decrease to $460.43 million (2021: $509.53 million).

The total equity as at March 31, 2022 amounted to $1.90 billion (2021: $1.65 billion). This resulted in a net asset value per share of $1.39 (2021: $1.21).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.