Date: June 07, 2019

Radio Jamaica Limited (RJR), for the year ended March 31, 2019, reported revenues of $5.48 billion versus $5.05 billion in 2018, increasing by 9% year over year. For the quarter, revenues closed at $1.28 billion (2018: $1.17 billion). Management noted that, “this was largely due to the staging of the FIFA World Cup tournament contributing $233 million and other broadcasting revenues, contributing $143 million in increased revenues.”

Direct expenses increased to $2.74 billion, this compares to the prior year’s figure of $2.51 billion, indicating a rise of 9%. For the quarter, direct expenses fell by 10% amounting to $595.03 million (2018: $662.40 million). The Company stated that, “this was due to the cost of the World Cup tournament which accounted for $258 million.”

As such, gross profit for the year end closed at $2.74 billion relative to $2.54 billion for the corresponding period in 2018. While for the quarter, gross profit totalled $680.85 million (2018: $509.52 million).

Total expenses increased by 7% for the period under review from $2.65 billion in 2018 to $2.84 billion in 2019.

There was a 9% increase in selling expenses to $811.08 million (2018: $745.82 million). RJR noted that, “this was due substantially to higher agency commissions, associated with higher revenues for the year.”

Administrative expenses closed at $1.26 billion (2018: $1.14 billion). Management highlighted that, “this was mainly due to year-end IAS and IFRS adjustments.”

Other operating expenses amounted to $765.33 million versus $770.59 million reported in the previous comparable period.

Other income dropped to total $126.75 million compared to the 2018 figure of $132.09 million. While, for the quarter, other income closed at $37.77 million (2018: $60.25 million).

Operating profit widened by 67% for the period in review, from $19.08 million in 2018 to $31.83 million in 2019. As for the quarter, there was an operating loss of $59.99 million in 2019 relative to an operating loss of $75.76 million in the prior corresponding period.

Finance costs increased by 18% year over year to $56.08 million versus $47.56 million in the prior year. While for the quarter, finance cost amounted to $9.93 million (2018: $17.91 million).

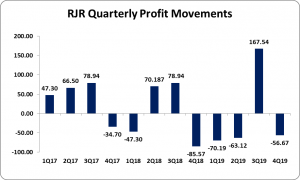

After tax credit of $1.81 million reported in 2019 compared to tax charges of $13.31 million in 2018, RJR recorded net loss of $22.44 million versus net loss of $41.79 million booked in 2018. For the quarter, net loss amounted to $56.67 million (2018: $85.57 million).

The loss per share (LPS) for the year end amounted to $0.01 versus $0.02 in 2018. For the quarter, LPS of $0.02 was recorded versus an LPS of $0.04. The number of shares used in this calculation was 2,422,487,654 units. RJR stock last traded on June 06, 2019 at $1.25.

Management also noted, “Overall in spite of a slow start to the year coupled with a World Cup campaign which fell short of profit targets, the Group rebounded to close the year with an improved performance as the market rewarded the Group’s industry leadership position in terms of audience and delivery of the most credible and entertaining content for and from Jamaica. That the Group ended in a loss position is attributable to the adjustments related to existing and newly adopted accounting standards, which were outside of the company’s control.”

RJR mentioned that, “the Group’s EBITDA continues to be significant following the adjustment for depreciation and amortization associated with the capital intensive nature of the business. The outlook for the 2019/20 financial year is for a turnaround and return to profitability to be achieved through even greater operating efficiencies and stronger focus on new business initiatives.”

Balance Sheet Highlights:

RJR, as at March 31, 2019, recorded ‘Total Assets’ of $3.72 billion, a decrease of 4% when compared to $3.88 billion for the previous corresponding period. The results were tempered by an increase in ‘Cash and Bank Balances’ and ‘Retirement Benefit Asset’ which closed at $446.43 million (2018: $266.97 million) and $214.85 million (2018: $187.73 million), respectively. Notably, receivables declined by $85.39 million to close at $914.31 million (2018: $999.70 million), while intangible assets declined to $397.29 million (2018: $537.70 million).

Total Shareholders’ Equity closed at $2.35 billion, down 2% from $2.40 billion last year. This resulted in a book value of $0.97 (2018: $0.99).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.