February 15, 2020

RJRGLEANER Communications Group (RJR) revenues for the nine months ended December 31, 2020, decreased by 13% to $3.79 billion compared to $4.34 billion for the comparable period the prior year. For the quarter, revenues decreased 6% to close at $1.49 billion (2019: $1.59 billion). The company noted, “the Audio-Visual segments reported increased revenues of $46 million or 5%, while the print segment which was most heavily impacted by the effects on business of the COVID-19 pandemic, reported a decline in revenues of $145 million or 20%.”

Additionally, Management indicated, “the impact of the pandemic on business saw advertisers reduce spending in almost every category of the business and with events being cancelled or indefinitely postponed, Group revenues were negatively impacted.” The revenue decline was partly offset by a number of initiatives, including online and broadcast education programmes and a series of virtual parties executed on our audio-visual and online platforms.”

Direct Expenses for the period decreased by 32% to $1.29 billion relative to $1.88 billion for the same period in 2019. As a result, gross profit for the period increased by 2% to 2.50 billion (2019: $2.46 billion). Gross profit for the quarter reflected a 1% decline to close the quarter at $1.03 billion, compared to $1.04 billion reported for the third quarter ended December 31, 2019.

The Company reported a 1% increase in total operating expenses to $2.35 billion when compared to $2.32 million posted in the same period in 2019. This was mainly attributed to a 13% increase in the company’s administration expenses from $926.82 million in 2019 to $1.05 billion, “due mainly to an increase bad debt provisions, and increased sanitation and safety protocols implemented in response to the ongoing pandemic.” as per RJR.

Selling expenses declined from $817.86 million in 2019 to $780.71 million. The Company noted, this was, “commensurate with the reduction in revenues.” Other operating expenses declined 11% to $518.50 million from 2019 nine months other operating expenses of $579.57 million.

Furthermore, in efforts to reduce expense RJR noted, “during the quarter, the Group maintained its aggressive cost reduction measures, including layoffs and redundancies, and the suspensions of some services, all in an effort to mitigate the reduction in revenues experienced. Safety protocols were also strengthened and maintained at a considerably higher cost in order to safeguard the wellbeing of our staff members and customers.”

Other income for the period amounted to $49.84 million (2019: $84.27 million) representing a 41% decrease year on year, due to reductions in Sundry Income in the Print Segment as noted by RJR. Thus, Operating profit of $206.79 million was reported for the period relative to an operating profit of $215.96 million reported in 2019, an11% decline.

Finance costs for the period decreased 26% moving to $32.75 million (2019: $44.21 million).

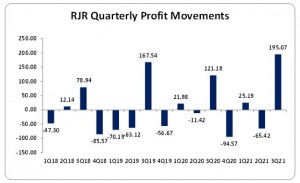

As a result, profit before tax amounted to $174.05 million relative to $171.75 million reported in 2019. After taxation of $46.94 million (2019: $37.36 million), the Company reported a net profit of $127.11 million (2019: $134.39 million) for the period. For the quarter, net profit amounted to $195.07 million relative to $121.56 million reported in 2019.

Earnings per share for the nine months amounted to of $0.052 relative to an EPS of $0.055 in 2019. For the quarter, the company reported earnings per share of $0.08 compared to $0.05 reported in 2019. The twelve trailing months loss per share amounted $0.01. The number of shares used in our calculations is 2,422,487,654 units. Notably, RJR’s stock price closed trading on February 15, 2021 at a price of $1.54 with a corresponding P/E of 114.66 times.

RJR noted, “the Group complete two significant investments during the quarter, which saw us increasing to 50% our interest in Jamaica Holdings LLC, operator of the Gustazos ecommerce platform which allows merchants to promote products and experience at very attractive discounted rates. The Group also signed an agreement to acquire a 10% stake in ePost Caribbean Limited, which offers a digital marketing toolset to include a newsletter platform, social media campaigns, online surveys, landing pages for online ads, ecommerce pages for small businesses and digital printing services.”

Balance Sheet Highlights:

As at December 31, 2020, the Company reported total assets of $4.09 billion, an increase of $181.62 million when compared to $3.90 billion in the prior year. This increase in the assets base is mainly as a result of an increase in ‘Cash and Bank Balances’ to $382.54 million (2019: $169.38 million).

Shareholders’ Equity as at December 31, 2020 was $2.45 billion a 1% increase compared to $2.44 billion for the prior year. This resulted in a book value per share of $1.012 (2019: $1.006).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.