Date: September 20, 2019

Revenue for the period decreased by 70%, amounting to $22.85 million in 2019 relative to $77.06 million in the same of last year. Management noted that, “this decrease was due to mainly the unavailability of pigs on the market; this shortfall in supply was however partially supplemented by revenue from slaughter service to third parties.”

SRA mentioned that, “our revenue for the quarter came from slaughtering fees and inventory sales. This is so as we have taken a temporary break from procuring pigs whilst we organize and recapitalize the business. We anticipate that, in short order we will to return to our core business of procurement of pigs and the sale of fresh cuts to processors, hotels, restaurants and wholesalers. It the latter that will ensure the company return to profitability and maximizes it true potential.”

Cost of sales declined by 78% to $15.54 million in 2019, down from $69.59 million in 2018. As a result gross profit fell slightly to $7.31 million, a 2% decrease when compared to $7.47 million for the same period of 2018.

Administrative expenses went down by 38% from $11.33 million in the first quarter of 2018 to $7.01 million in the corresponding quarter of 2019.

Consequently, SRA recorded operating profit for the period of $302,736 relative to an operating loss of $3.86 million for the prior year.

Finance costs closed the period at $1.87 million, a 42% reduction when compared to $3.23 million for the corresponding period last year while finance income of $515,000 was recorded for quarter relative to $1.20 million in 2018.

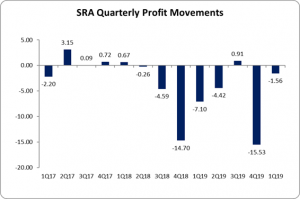

Thus SRA recorded net loss of $1.56 million when compared to last year’s net loss of $7.10 million, a 78% decline.

The loss per share for the three month period amounted to $0.02 versus a loss per share of $0.09 for the corresponding period last year. The trailing twelve months loss per share amounted $0.28. The number of shares used in this calculation was 81,531,043 units. SRA closed the trading period at $2.75 as at September 19, 2019.

The Company stated that, “the importance of having a local facility such as ours cannot be over emphasized when one considers the reach of the plant over the past three (3) years. Over the period, over 20,000 pigs were purchased from over 400 farmers from 7 rural parishes. The economic benefit and the foreign exchange savings are significant not just for the farmers and their family but for the country.”

Balance Sheet Highlights:

As at June 30, 2019, SRA recorded total assets of $386.62 million, a decrease of 5% when compared to $404.97 million for the 2018 quarter one period. The decline was attributed to a 4% decline in ‘Property, Plant & Equipment’ which closed at $316.63 million (2018: $330.43 million), while ‘Trade and other Receivables’ dropped 18% to $17.06 million relative to $20.76 million booked as at June 30, 2018.

Total Stockholders’ equity as at June 30, 2019 closed at $19.64 million, down 53% from $42.07 million last year. This resulted in a book value of $0.24 compared to $0.52 as at June 30, 2018.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.