April 29, 2019

Supreme Ventures Limited (SVL), for the Three Months Ended March 31, 2019 reported a 14% increase in Total Gaming Revenue from $8.07 billion in 2018 to $9.30 billion in 2018.

- Revenues from the company’s segments were as follows:

- Revenue from Non fixed odd wagering games, horse racing and pin codes- $5.42 billion (2018: $4.76 billion), a 14% increase

- Income from fixed odd wagering games, net of prizes- $3.88 billion (2018: $3.31 billion), a 17% increase.

Direct expenses recorded an increase to close the period at $7.40 billion when compared to $6.41 billion for the same period in 2018. As such, gross profit for the period improved 15% to $1.90 billion (2018: $1.66 billion). Management noted the increase was, “attributed to the higher sales for Cash Pot, Pick 4, Money Time, Super Lotto, Pin codes horseracing and sports betting.”

Operating expenses grew by 5% for the period to $948.45 million (2018: $903.05 million) while the booked other losses of $10.20 million relative to other income of $73.37 million the prior period. Management noted, “the increase in the Group’s operating expenses can be attributed to the activities associated with the launch of Mobile Gaming in March 2019. This expenditure should have a significant positive return in the form of sales from the Mobile platform. We continue to exercise due care in the management of the operating expenses.

Consequently, operating profit for the period increased 14% to $943.25 million relative to $903.05 million reported in 2018.

Finance costs increased 90% for the period to total $31.40 million (2018: $16.51 million). As such, Profit before Taxation amounted to $911.85 million, up from $810.42 million in 2018.

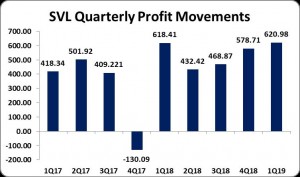

Taxation for the year rose 52% to close at $290.96 million in compared to $192.01 million in 2018. Net Profit after tax amounted to $620.88 million, a 0.4% increase from the $618.41million recorded for the prior financial year.

Earnings per share totaled $0.24 for the period (2017: $0.23). The number of shares used in our calculations 2,637,254,926 units. Notably, SVL’s stock price closed the trading period on April 26, 2019 at a price of $26.21.

Management noted, “The Group will continue to maintain the positive momentum in the first quarter through the implementation of key strategic initiatives for the remainder of the year. The launch of Mobile Gaming platform in March in a major achievement and we will continue to capitalize on user awareness and sign up in the coming months. Additionally, as part of our ongoing strategic focus to increase our footprint in the online market, SVL is moving ahead in its plans for online gaming, another game changing and innovative product for the Group.

Balance Sheet at a glance:

As at December 31, 2018, Supreme Ventures Limited had assets totaling $7.06 billion relative to $5.74 billion a year earlier. The increase was due mainly to a 13% and 22% increase in ‘Cash and Bank Balances’ and ‘Property, plant and equipment’. ‘Cash and Bank Balances’ and ‘Property, plant and equipment’ closed the quarter at $2.55 billion (2017: $2.25 billion) and $1.50 billion (2017: $1.18 billion)

Shareholders Equity amounted to $3.46 billion (2017: $3.21 billion) with a book value per share of $1.31 (2017: $1.22).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.