November 15, 2021

In United States dollars (except where it is indicated otherwise)

Sygnus Credit Investments Limited, for the three months ended September 30, 2021 reported Interest Income of approximately US$2.24 million, a 32% increase on the US$1.70 million recorded in 2020. Interest expense for the quarter amounted to US$416,011 (2020: US$412,546), resulting in net interest income of US$1.82 million (2020: US$1.29 million).

The Company reported Fair Value Gains of US$448,765 (2020: US$47,744) and other income was US$22,997 in 2020. As such, Sygnus reported first quarter total revenue of US$2.72 million compared to US$1.36 million in 2020.

Total Expenses for the three months amounted to US$735,261 a 32% increase relative to US$559,043 recorded for the corresponding quarter in 2020. Of total expenses:

-

- Management fees amounted to US$442,875 (2020: US$303,004).

- Other expenses amounted to US$124,797 (2020: US$108,568).

- Net foreign exchange loss for the quarter closed at US$10,325 (2020: US$34,198).

- SYGNUS reported US$29,148 for impairment allowance on financial assets relative to US$54,718 in 2020.

- Performance fees amounted to US$50,939 (2020: nil).

- Corporate service fees totalled US$77,177 (2020: US$58,555). The Company noted that, “Performance fees were charged for the first time at the end of the June 2021 financial year, as the performance hurdle rate was exceeded. Management fees and corporate services fees were a combined 74.7% of operating expenses, while all three fees inclusive of the performance fees were a combined 82.1% of operating expenses.”

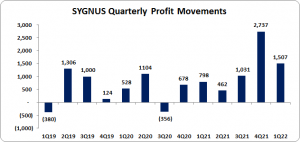

Profit before taxation for the quarter closed at US$1.54 million relative to a profit of US$797,840 for the same quarter in 2020. Taxation charge amounted to US$30,223 (2020: nil), which resulted in net profit of US$1.51 million (2020: US$797,840).

Total comprehensive income also closed at US$1.51 million (2020: US$797,840) for the period under review.

As a result, Earnings per share (EPS) for the quarter amounted to US$0.0026 (2020: EPS of US$0.0014). The trailing twelve months EPS amounted to US$0.0097. The number of shares used in our calculations amounted to 590,975,463 units. Notably, SCIJMD and SCIJA closed the trading period on November 12, 2021 at a price of J$18.53 and J$13.06 respectively. SCIUS and SCIUSD closed the trading period on November 12, 2021 at US$0.12 and US$0.14, respectively.

SYGNUS noted, “Portfolio Companies were diversified across 11 major industries and 7 regions within the Caribbean in 3 Month 2021 vs 10 industries and 7 regions for 3 Month 2020. Excluding dry powder, the top four industry allocations were Financial: 25% (up from 11% last year); Hospitality: 15% (down from 16% last year); Infrastructure: 13% (down from 17% last year); and Manufacturing: 13% (down from 17% last year). Industry concentration remains substantially below the 35% target concentration level but should be expected to increase as economic recovery within the Caribbean gathers pace. Portfolio companies from Jamaica accounted for the highest allocation of SCI’s Portfolio with 49%, followed by St Lucia with 17%, the Dutch Caribbean Islands of Saba, St Eustatius and St Martin (SSS islands) with 13% and Barbados with 11%.”

Balance Sheet Highlights

As at September 30, 2021, Sygnus’ total assets amounted to US$93.89 million, a 37% increase on 2020’s assets base of US$68.53 million. This was primarily due to an increase in ‘Investments’ to US$86.60 million (2020: US$60.34 million).

Total Stockholders’ equity as at September 30, 2021, closed at US$66.69 million, slight increase from US$37.60 million for the corresponding period last year. This resulted in a book value per share of US$0.11 (2020: US$0.06).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.