Date: February 27, 2018

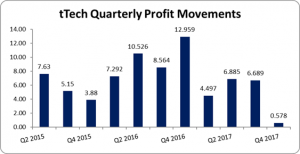

tTech reports 53% decline in twelve months net profit, for the year ended December 31, 2017, booked a 3% decline in revenues to $217.25 million compared to $223.16 million for the prior financial year.

Cost of sales fell 14% to $28.08 million from the $32.75 million reported in December 2016. As such gross profit from declined 1% for the year to $189.17 million (2016: $190.42 million).

Other Income, gains and losses year over year posted a loss of $439,000 relative to a gain of $9.29 million in 2016, while administrative expenses rose 5% year over year to $149.87 million (2016: $143 million). Other operating expenses for the year reflected a 9% growth year over year to $20.20 million compared to $18.48 million recorded in 2016.

Consequently, Profit before Taxation decreased by 51% from $38.22 million in 2016 to $18.65 million. No Taxes were recorded for the period, thus Net Profit for the year amounted to $18.65 million versus $38.22 million booked in 2016.

The earnings per share (EPS) for the year amounted to $0.18 compared to $0.37 reported in 2016. The number of shares used in our calculations is 106,000,000 units. The company’s stock price closed the trading period on February 26, 2018 at $5.00.

Balance Sheet Highlights:

As at December 31, 2017, the Company reported total assets of $208.77 million, a 6% increase when compared to $196.05 million in 2016. This was as a result of an increase in investments which amounted to $26 million (2016: $2.03 million).

Shareholders’ Equity as at December 31, 2017 was $178.38 million compared to $163.97 million for the comparable period of 2016. This resulted in a book value per share of $1.68 compared to $1.55 the prior year.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.