Date: August 16, 2021

Wigton Windfarm Limited, for the three months ended June 30, 2021, reported sales of $636.63 million, a 15% decrease on the $750.89 million reported in the prior year. WIG noted that, “the change was largely due to (i) the lower level of production, and (ii) the approximate 50% rate reduction in United States dollar for Wigton Phase II which commenced this quarter.”

Cost of sales went up 3% to close the first quarter at $213.41 million versus $207.69 million booked in the previous comparable quarter. As such, gross profit fell to total $423.22 million (2020: $543.20 million).

Other income amounted to $32.96 million, a 52% decrease when compared to $68.78 million in the same period last quarter. In addition, general administrative expenses increased for the quarter amounting to $174.70 million relative to $92.19 million documented in the same quarter in the previous year. Management noted that the increase was due to:

“An increase in insurance premium expense because of the perceived higher risk of hurricanes in the Caribbean region

The increase of staff payments made in accordance with the Company’s Policies and an inflationary adjustment to staff salaries which was long overdue as no increase was granted during the 2020/2021 financial year

Higher critical major maintenance costs incurred during the quarter versus the SPLY.”

Consequently, operating profit booked a 46% decrease closing the period under review at $281.48 million (2020: $519.79 million).

Finance expense trended downwards from $124.11 million in 2020 to $102.22 million in 2021.

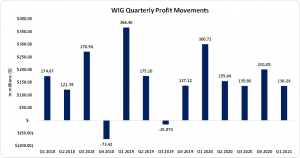

Additionally, profit before taxation went down by 55% to close at $179.27 million (2020: $395.68 million). After taxation of $43.02 million (2020: $94.96 million), net profit for the quarter ended June 2021 closed at $136.24 million versus $300.71 million booked in the similar period last year.

Earnings per share (EPS) was $0.012 for the first quarter compared to $0.027 in 2020. The twelve-month trailing EPS amounted to $0.057. The number of shares used in the calculations is 11,000,000,000. WIG stock price closed the trading period on August 13, 2021 at $0.55 with a corresponding P/E of 9.63 times.

Management noted that, “Wigton anticipates a call for renewable energy in the near term given that the Ministry of Science , Energy and Technology (MSET) has indicated that the Integrated Resource Plan, which addresses electricity supply for the next twenty (20) years, targets more than 500MW of capacity to the national grid to be procured by 2025. The Company remains ready to respond with proposals to develop utility scale projects for connectivity to the national grid.”

Balance Sheet Highlights:

As at June 2021, Wigton’s total asset base went up by 1% amounting to $11.04 billion (2020: $10.96 billion). The increase was as a result of increases in ‘Accounts Receivables’ and ‘Cash and Deposits’ which closed at $508.19 million (2020: $470.65 million) and $3.53 billion (2020: $3.02 billion), respectively. However, the increase was partially tempered by a decrease in ‘Property, Plant & Equipment’ closing the period at $6.82 billion (2020: $7.27 billion).

Shareholders’ Equity amounted to $4.36 billion relative to $3.76 billion in 2020 resulting in a book value per share of $0.40 relative to $0.34 in 2020.

DISCLAIMER

Analyst Certification –This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.