Date: May 28, 2019

Sagicor Real Estate XFUND Limited, for the three months ended March 2019, reported total revenue of $1.78 billion relative to $3.39 billion recorded in 2018, a 48% decline year over year. XFUND mentioned that, “This is as a result of the change in the business model, with the sale of the hotels last year and lower returns from the Sigma Real Estate Portfolio. Our hotel operations segment which now comprises of DoubleTree and part of JGM, reflects this reduction.”

Hotel revenue from continuing operations for the three months decreased to $1.73 billion in 2019 versus $3.29 billion in 2018, a 47% decline year over year. Net capital gains amounted to $41.98 million (2018: $96.10 million), while interest income closed at $5.28 million (2018: $6.97 million).

Management stated that, “Reduction of $176 million or 95% in gains from the investments in the Sigma Real Estate Fund year over year. This was due to a reduction in the number of units held, down from 7.17 billion in 2018, to 402 million as at 31 March 2019. On 1 July 2018, the Group liquidated 91% of its units in the Sigma Real Estate Fund, exchange for 51.86% ownership of Jamziv.”

Operating expenses fell 45% to $1.54 billion compared to $2.77 billion in the prior corresponding period. Of this:

Hotel expenses declined to $1.21 billion, down 43% when compared to $2.13 billion in the prior corresponding period.

Depreciation closed at $164.01 million (2018: $246.35 million)

Interest expenses decreased to $146.46 million (2018: $378.99 million).

Other operating income fell by 20% to total $13.93 million (2018: $17.51 million).

Share of profit from associate accounted for using the equity method amounted to $ 856.98 million relative to nil the prior year.

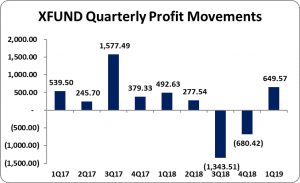

The Company reported profit before tax of $1.10 billion relative to profit before tax of $621.92 million for the three months period. After incurring tax charges of $69.08 million (2018: $129.28 million), net profit for the first quarter of 2019 closed at $1.03 billion compared to net profit of $492.63 million in March 2018.

XFUND recorded net profit attributable to shareholders of $694.57 million (2018: $492.63 million). As such, earnings per share (EPS) for the three months period amounted to $0.31 (2018: $0.22). The trailing twelve-month EPS is $0.16. The number of shares used in our calculations was 2,243,005,125. As at May 29, 2019, the stock traded at $9.91.

Furthermore, it was stated that, “Jamziv Mobay Jamaica Portfolio Limited (Jamziv), which holds the Playa shares contributed share of profit from associate of $859 million. Jewel Grande Montego Bay (JGM) recorded a profit for the first three month of 2019, contributing net income of $32 million. The property is now being managed by Playa, and has seen marked improvements in occupancy levels and average daily rental rates. In the prior year, JGM recorded a net loss of $70 million for the three month period ended March 2018. Interest and other financing costs was lower by $233 million, as cash proceeds from the sale of Hilton Rose Hall Resorts and section of Jewel Grande Montego Bay in June 2018 was used to paydown borrowings and other obligations in 2018.”

The Company noted that, “Sigma Real Estate Fund’s holdings in the “Jewel” branded hotel operations were also sold to Playa on June 2, 2018, therefore it’s primary investments now include 39.19% of Jamziv, 20% holding in JGM and ownership of several office/retail shopping buildings, industrial/warehousing properties and prime land holdings slated for development. This accounts for the lower revenues, EBITDA and net income recorded year over year.”

In addition, XFUND highlighted that, “We remain focused on the execution of the X Fund strategic plan to be the leading REIF in the Caribbean. We are seeing benefits from the 2018 reorganization of our business model and anticipate positive return on investments going forward.”

Balance Sheet Highlights:

The Company, as at March 2019, recorded Total Assets of $49.08 billion, a slight increase when compared to $48.48 billion recorded as at March 2018. This was as a result of an increase in ‘Investment in Jamziv Limited’ to $28.23 billion relative to nil the prior year. This was however tempered by the reductions in ‘Property, plant and equipment’ and ‘Investment in Sigma Global Fund – Real Estate Portfolio’ to $14.47 billion (2018: $26.20 billion) and $783.47 million (2018: $15.39 billion) respectively.

Total Shareholders’ Equity as at March 31, 2019 closed at $25.35 billion, a 9% increase from the $23.24 billion recorded for the corresponding period last year. This resulted in a book value per share of $11.30 (2018: $10.36).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.