Jamaican Teas Limited (JAMT) reported revenue for the second quarter ended March 2017 of $386.11 million, an increase of 37% compared to the $281.30 million booked for the corresponding period in 2016. Year to date, the company reported a 21% increase in Revenue to total $760.01 million (2016: $625.91 million). According to the company, “Export sales increased by $40 million, while our residential property sales recorded an increase of $60 million for the quarter.” Other Income increased by 48% for the quarter moving from $14.94 million in 2016 to $22.09 million in 2017.

Cost of sales increased 24% to $589.90 million (2016: $474.20 million). As a result, Gross Profit grew 12% to $170.11 million, while for the quarter JAMT posted a 13% improvement to $84.02 million (2016: $74.26 million).

Notably, Other income reported a 38% growth year over year to $38.98 million relative to $28.30 million a year earlier.

With Regards to the company’s Real Estate the company stated that “We completed sales of eight (8) residential units in the current Quarter compared to none in the comparative period of the prior year. This brings the total number of units sold and delivered in the Orchid Estate project to thirty seven (37). We currently have another twenty five (25) units in the scheme under sales contracts. We expect that construction will be completed around the close of the third quarter.”

Administrative Expenses increased by14% to $62.82 million for the six months ended March 2017 relative to $55.25 million for the same period of 2016. Sales and Marketing cost declined by 1% for the period relative to 2016 closing at $17.91million (2016: $18.07 million). There was a 19% reduction in finance cost moving from $20.25 million for the same period last year to $16.31 million in 2017. Total expenses closed with an overall 4% increase, JAMT noted that it was mostly due to an increase in staff costs.

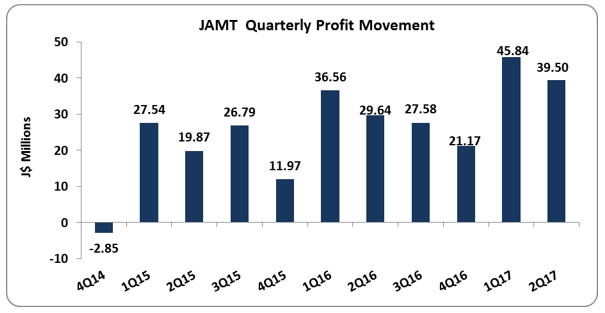

Pre-tax profits climbed by 38% for the 6 months ended March 2017 from the prior year, increasing from $81.33 million to $112.05 million. JAMT incurred tax expenses of $13.56 million compared to $10.90 million during the 2016 comparable period. Despite the increase in taxes, Net Profit after discontinued operations increased by 33% for the quarter totalled $39.50 million (2016:29.64 million). For the six months Net Profit after discontinued operation increased by 35% to close the period at $85.33 million (2016: $63.33 million). This follows Non-operating Expenses for the period of $8.60 million (2016: Nil) and Loss from Discontinued Operations of $4.56 million (2016: 7.10 million).

Consequently earnings per share increased to $0.25 compared to $0.19 in the six months ended March 31, 2016, while for the second quarter JAMT book an EPS of $0.12 (2016: $0.09). The trailing twelve month EPS was $0.20.

Balance Sheet at a glance:

As at March 2017, the company’s assets totalled $1.28 billion, an increase of 1% compared to the $1.27 billion reported as at March 2016. The growth was driven primarily by a 75% increase in Investments from 119.45 million in 2016 to 209.42 million for the period reported.

Shareholders’ equity amounted to $965.91 million as at March 31, 2017 (2016: $822.50 million) resulting in a book value per share of $2.86 (2016: $2.43).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.