Date: November 14, 2018

For the nine months ended September 30, 2018, Kingston Wharves’ revenue totaled $5.26 billion a 16% increase when compared to $4.52 billion for the corresponding period of the prior year, while revenue for the second quarter grew 18% to $1.87 billion (2017: $1.58 billion). This as both the company’s ‘Terminal Operations’ and ‘Logistics & Ancillary Service’ segments reported increases.

-

- The ‘Terminal Operations’ which accounted for 81% of total revenues, increased 21% year over year to a total of $4.28 billion relative to $3.53 billion last year. According to KW, “Gains in this division are attributable to strategic investments in the infrastructure, operating equipment and the human capital directly involved in the business processes that are core to this division.”

-

- The company’s ‘Logistics & Ancillary Services’ grew 26%, to total $1.33 billion, up from $1.05 billion. The company highlighted that, “This improvement is a direct result of KWL’s investments in automotive logistics, warehousing and distribution and container freight station services. The company has undertaken aggressive efforts to position its growing customer base to benefit from the commercial opportunities that will arise from the Jamaica Special Economic Zone framework and efficiency improvements in customs-related activities.”

Cost of sales rose 17% to a total of $2.76 billion (2017: $2.36 billion). As such, gross profit grew by 15% for the period to total $2.50 billion relative to $2.16 billion recorded a year ago. Gross profit within the second quarter rose 22% to close at $908.03 million compared to $743.17 million booked for the quarter ended September 30, 2017.

Other operating income soared year over year, to total $282.13 million (2017: $62.08 million). Administrative expenses went up by 10%, amounting to $864.30 million relative to $786.96 million for the same period last year.

As such, operating profit closed the period at $1.92 billion, 33% more than the prior year’s corresponding period of $1.44 billion. Operating profit for the quarter improved 43% to $745.45 million versus $520.89 million in 2017.

Finance costs for the year advanced 86%, to close at $170.10 million for the period relative to $91.59 million booked for the corresponding period in 2017.

Profit before taxation rose 30% to $1.75 billion for the period in contrast to the $1.35 billion in 2017.

Income tax expense for the period increased 95% to $300.65 million compared to $153.86 million for the corresponding period in 2017. Consequently, Profit for the period moved from $1.19 billion to $1.45 million, a 21% growth year over year.

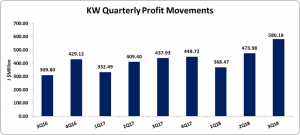

Net profits attributable to shareholders for the nine months rose by approximately 21% to total $1.42 billion relative to $1.18 billion in 2017. third quarter profit attributable to shareholders improved 32% to close at $580.18 million. (2017: $437.3million).

Earnings per share for the nine months ended September 30, 2018 amounted to $0.99 (2017: $0.82), while for the quarter, the EPS was $0.41 (2017: $0.31). The trailing earnings per share EPS totaled $1.31. The total number of shares used in the calculations amounted to 1,430,199,578 units. KW closed the trading period on November 13, 2018 at a price of $76.75.

Management indicated, “As we enter the final quarter of 2018, we remain optimistic about the Company’s performance. We are devoting considerable resources to maintain a consistently high level of service delivery to our clients. We are particularly focused on directly facilitating our Jamaican commercial clients who depend on the timely and efficient trade in goods for the growth and development of their businesses. We clearly recognize that growth in the Jamaican economy will depend on the competitiveness of these businesses and we will work closely with them to ensure that our terminal operates in alignment with their interests.”

In addition the Company sees the potential, “for the development of Jamaica as a logistics hub for the distribution of a range of cargo types throughout the region and are investing in the facilities necessary to deliver on the growth prospects for this business. Finally, we appreciate that individuals will increasingly use technology to source goods from all over the world and we intend to facilitate this by steadily improving the ease with which any individual can import and export cargo through our terminal. These objectives are clear for us, and during the quarter and year-to-date, the Company accomplished some key wins on all of them. Notwithstanding the challenges within the industry, we expect to close the financial year in a solid profit position, maintaining our focus on growing our capacity, expanding our business and returning value to our shareholders.”

Balance Sheet Highlights:

As at September 30, 2018, the company’s assets totaled $31.06 billion relative to $25.07 billion a year ago, an increase of 24%, which was driven mainly by an increase in ‘Property, Plant and Equipment’ to total $22.77 billion from $19.11 billion. Short term investments assets however tempered this growth in the asset base with an 86% decrease to $4.27 billion (2017: $3.25 billion).

Shareholders’ Equity amounted to $23.86 billion compared to equity of $19.47 billion reported as at September 30, 2017. The Company now has a book value per share of $16.68 (2016: $13.61).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.