Date: August 14, 2019

Kingston Wharves Limited (KW) for the six months ended June 30, 2019 revenue totaled $3.80 billion a 12% increase when compared to $3.39 billion for the corresponding period of the prior year, while revenue for the second quarter grew 12% to $1.97 billion (2018: $1.76 billion); as both the company’s ‘Terminal Operations’ and ‘Logistics Service’ segments reported increases.

The ‘Terminal Operations’ grew by 10% over the corresponding period of the prior year to a total of $3.05 billion relative to $ 2.78 billion last year. Management noted, “The Terminal Operations division handles a range of cargo types including break-bulk, bulk, automotive and containerised cargo. The business also includes both domestic and transhipment cargo. Strategic initiatives over many years to diversify the business have proven to be valuable. High performance in a number of operational areas, made up for flat showing in some aspects of the business, enabling KWL to maintain the positive growth which marked the start of the year.”

The company’s ‘Logistics Services’ grew 21%, to total $999.28 million, up from $825.46 million. The company highlighted that the “Key investment in logistics facilities and systems have already positioned KWL to capitalize on the rapidly growing logistics services market, in or near the Port of Kingston. Our automotive logistics service and warehousing operations remain strong, despite some softening of demand for international logistics services connected with motor vehicles and containerised cargo due to global geo-political instability and some local competition from other market participants. KWL has responded well to Chairman’s Statement 2 these challenges by diversifying and adding value and expertise to its service offering beyond traditional warehousing operations, while continuing to deliver cargo handling services related to the loading, discharging, stripping and stuffing of full container loads and less-than-container-loads.”

Cost of sales rose 3% to a total of $1.84 billion (2018: $1.80 billion). As such, gross profit grew by 23% for the period to total $1.96 billion relative to $1.59 billion recorded a year ago. Gross profit within the second quarter rose 21% to close at $1.03 billion compared to $846.14 million booked for the quarter ended June 30, 2018.

Other operating income increased year over year, to total $166.40 million (2018: $164.13 million). Administrative expenses went up by 6%, amounting to $618.11 million relative to $583.71 million for the same period last year.

As such, operating profit closed the period at $1.51 billion, 28% more than the prior year’s corresponding quarter of $1.17 billion. Operating profit for the quarter improved 32% to $893.70 million versus $675.07 million in 2018.

Finance Costs for the year declined 20%, to close at $93.52 million for the period relative to $116.26 million booked for the corresponding period in 2018.

Profit before taxation rose by 34% to $1.41 billion for the period in contrast to the $1.06 billion in 2018.

Income tax expense for the period increased by 7% to $214.05 million compared to $200.16 million for the corresponding period in 2018. Profit for the six months moved from $855.38 million to $1.20 billion, a 40% growth year over year.

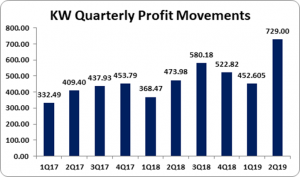

Net profits attributable to shareholders for the six months rose by approximately 40% to total $1.18 billion relative to $842.45 million in 2018. Second quarter net profit attributable to shareholders improved 54% to close at $729.01 million (2018: $473.98 million).

Earnings per share for the six months ended June 30, 2019 amounted to $0.83 (2018: $0.59), while for the quarter the EPS was $0.51 (2018: $0.33). The trailing earnings per share EPS totaled $1.60. The total number of shares used in the calculations amounted to 1,430,199,578 units. KW stock price closed the trading period on August 13, 2019 at $66.41

Management noted that, “Kingston Wharves is confident that our diversified range of products and services will enable us to identify and execute on attractive growth opportunities while maintaining our core business profitability. Despite the challenges facing businesses generally and those engaged in global trade in particular, Kingston Wharves is optimistic about the short, medium and long term. We will continue to diversify our product offering, expand our logistic services and forge new partnerships to grow our client base.”

Balance Sheet Highlights:

As at June 30, 2019, the company’s assets totaled $32.74 billion relative to $30.35 billion a year ago, an increase of 8%, which was driven mainly by an increase in ‘Retirement Benefit Asset” to total $1.99 billion from $1.17 billion. The company also booked ‘Right of use asset’ of $969.40 million relative to nil the prior year.

Shareholders’ Equity amounted to $25.55 billion compared to equity of $23.27 billion reported as at June 30, 2018. The Company now has a book value per share of $17.86 (2018: $16.27).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.